Research Report: Funding Future Founders: Exploring Access to Capital and Creative Financing Options for Teen Startups

This comprehensive report examines Funding Future Founders: Exploring Access to Capital and Creative Financing Options for Teen Startups through extensive research and analysis.

Key Research Takeaways

- Comprehensive Analysis: This report covers all major aspects of Funding Future Founders: Exploring Access to Capital and Creative Financing Options for Teen Startups

1. Executive Summary

The entrepreneurial landscape is undergoing a transformative shift, driven significantly by the burgeoning ambition of the younger generation. Today’s teenagers, often referred to as Gen Z, are increasingly looking beyond traditional career paths, exhibiting an unprecedented desire to forge their own ventures. This Executive Summary explores the dynamic rise in teen entrepreneurship, the significant hurdles they encounter in securing essential capital, and the innovative solutions and burgeoning support systems that are actively bridging this financing gap. It provides a strategic overview of these trends, highlighting key data, insights, and exemplary cases that underscore the immense potential—and the critical unmet needs—of this emerging demographic of founders.

Gen Z’s Entrepreneurial Surge: A New Era of Teen Startups

A profound cultural and ideological shift is evident in the career aspirations of today’s youth. Entrepreneurial ambition among teenagers is currently surging at record levels, distinguishing Gen Z as a cohort more inclined to start their own businesses than any preceding generation. A recent 2022 survey conducted by Junior Achievement revealed that a striking 60% of U.S. teens expressed a preference for launching their own business over pursuing a traditional job [19]. This figure marks a substantial increase from just 41% in 2018 [20], indicating a significant post-pandemic acceleration in the entrepreneurial mindset. This growing interest is not confined to the United States but is observed globally, fueled by the rising prominence of young CEO role models, an increasingly “startup-savvy” popular culture, and the unprecedented accessibility afforded by e-commerce and digital platforms. In numerous high-income economies, youth entrepreneurship is now perceived as both “cool” and attainable, shedding its former niche status.

The pervasive influence of technology and social media has been a critical enabler of this trend. Unlike previous generations, Gen Z has grown up immersed in social media, online marketplaces, and a plethora of low-cost digital tools, which dramatically lowers the barriers to entry for launching a venture from virtually anywhere. Teenagers can now conceptualize, design, and market products; establish online storefronts via platforms like Shopify; or monetize hobbies through content creation with minimal initial capital. This inherent “digital nativity” fosters experimentation and reduces the traditional costs associated with piloting business ideas. For instance, a contemporary teen startup might manifest as an online clothing brand or a mobile application gaining rapid traction through viral marketing campaigns on platforms such as TikTok. The reduced financial outlay required to test and iterate on business ideas actively encourages more teenagers to embark on entrepreneurial journeys.

The COVID-19 pandemic era (2020–2022) also played a pivotal role in catalyzing youth entrepreneurship. Disruptions to traditional schooling and conventional part-time job opportunities prompted many young individuals to explore side hustles and establish online businesses. Surveys conducted between 2021 and 2022 documented a notable surge in teens engaging in online product sales, tutoring, or monetizing their hobbies during lockdown periods. This experiential learning not only imparted practical business skills but also profoundly reshaped attitudes. Rather than exclusively pursuing “safe” corporate careers, a significant proportion of teenagers now perceive creating their own employment as a viable and attractive alternative. These structural changes underscore a long-term trajectory toward increased youth-driven startups, poised to foster innovation and job creation if adequately nurtured and supported.

Despite this global surge in entrepreneurial ambition, variations exist across different regions. In the European Union, approximately 40% of young individuals (aged 15–30) express a desire to be self-employed [21]. However, the actual rate of self-employment among youth remains considerably lower, at only about 7% [22]. This disparity can be attributed to factors such as robust social safety nets and a cultural inclination towards stable employment opportunities. Conversely, in many emerging economies, youth entrepreneurship rates tend to be higher, often driven by necessity due to a scarcity of formal employment sectors. In these regions, young individuals frequently engage in informal micro-entrepreneurship or the gig economy to secure livelihoods. The underlying drivers thus diverge: in developed nations, entrepreneurship is often a pursuit of opportunity and innovation, while in developing regions, it can be a means of survival. Nevertheless, in both contexts, enhanced access to capital holds the potential to empower these young founders, enabling them to transition beyond subsistence-level operations and achieve sustainable growth.

The implications of this entrepreneurial surge are far-reaching. The emergence of millions of “future founders” necessitates a proactive response from educational institutions and policymakers. This includes the integration of entrepreneurship courses into high school curricula, the organization of startup competitions, and the deliberate highlighting of successful young entrepreneurs. For businesses and investors, this trend presents new avenues for growth and opportunity, as tomorrow’s groundbreaking startups may very well originate from today’s 16- or 17-year-olds. However, it also underscores the critical need for robust support systems, encompassing mentorship, clear legal frameworks, and accessible financing, to prevent this enthusiasm from being stifled by preventable obstacles. The overall trajectory points towards a significant increase in youth-led startups entering the global economy, promising to catalyze innovation and job creation if properly supported and integrated into the broader entrepreneurial ecosystem.

| Metric | 2018 Data | 2022 Data | Trend |

|---|---|---|---|

| U.S. Teens Preferring Entrepreneurship | 41% [20] | 60% [19] | +19% (Significant Increase) |

| EU Youth Aspiring to Self-Employment | ~40% [21] | ~40% [21] (Consistent) | Stable aspiration |

| EU Youth Self-Employed | ~7% [22] | ~7% [22] (Consistent) | Stable (but low) participation |

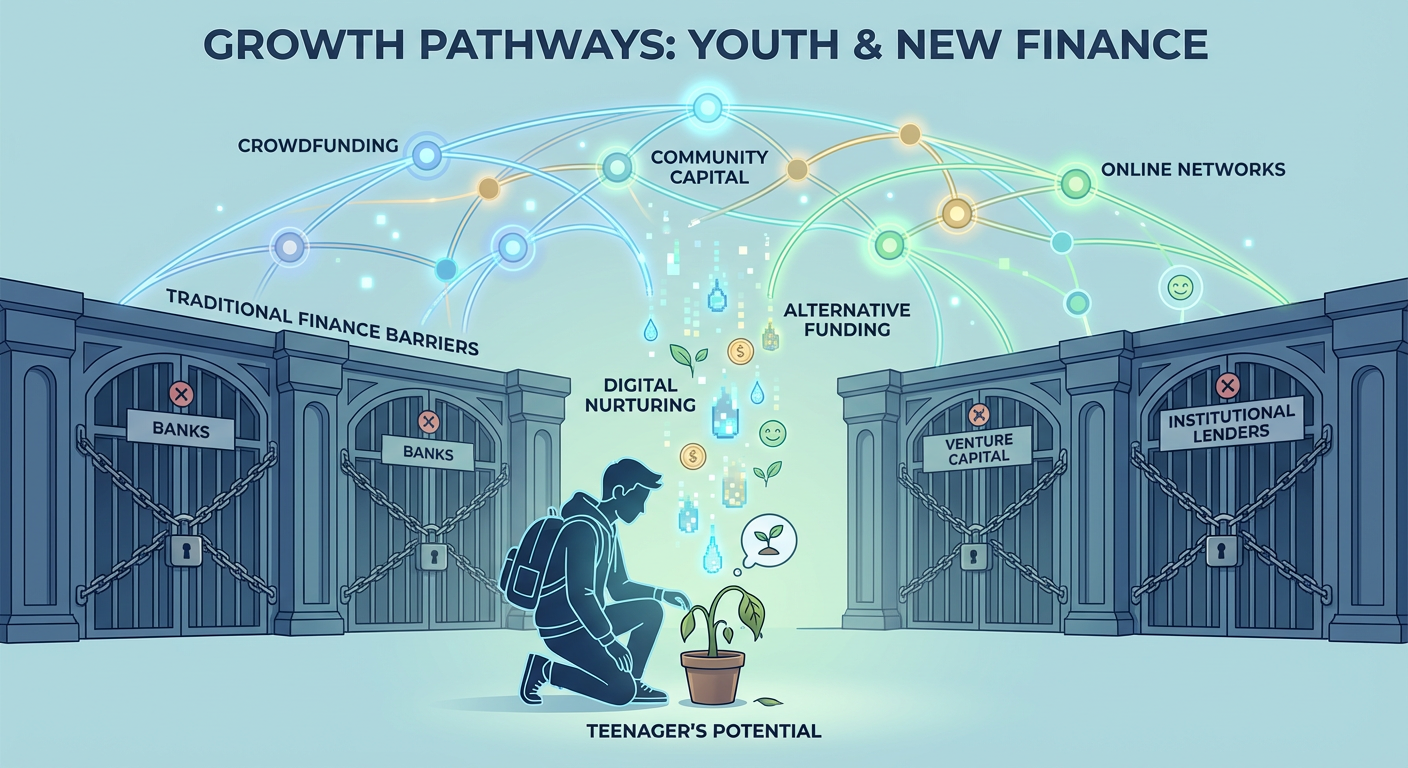

The Capital Gap: Funding Challenges Facing Teen Founders

Despite the escalating entrepreneurial zeal among teenagers, a significant hurdle persists: access to capital. This “capital gap” is arguably the primary obstacle preventing many young, aspiring founders from transforming their innovative ideas into viable businesses. Nearly 40% of young entrepreneurs (aged 15–30) in Europe identified the lack of funding and resources as their foremost challenge in initiating a business venture [23]. This consistent finding across various surveys highlights a systemic issue that disproportionately affects young individuals.

Traditional financing mechanisms present substantial barriers for young entrepreneurs. Commercial banks typically mandate a proven credit history, collateral, and a stable income—criteria that most teenagers, still in school or at the nascent stages of their careers, cannot fulfill. Furthermore, in many legal jurisdictions, minors (under the age of 18) are legally incapacitated from signing business loans or establishing credit lines without the co-signature of a legal guardian. This structural impediment means that when teenagers attempt to secure conventional business loans, they often encounter closed doors. Even fundamental necessities, such as opening a business bank account or obtaining a credit card, frequently require parental or guardian involvement. Consequently, young entrepreneurs are compelled to seek alternative funding avenues or operate their ventures on an extremely limited budget.

The skepticism from investors, particularly venture capital (VC) firms and angel investors, has historically compounded this challenge. These entities have traditionally shown reluctance to back very young founders unless they exhibit exceptionally disruptive ideas or extraordinary traction. Common investor concerns revolve around teenagers’ perceived lack of business experience, unproven execution capabilities, and the potential for academic commitments or parental constraints to divert attention from their startups. Many investors openly prioritize founders in their late 20s to 40s, with the average age of a funded startup founder typically falling in the mid-30s. While there are iconic exceptions, such as Mark Zuckerberg of Facebook who started at 19, teen CEOs frequently face an uphill battle to be taken seriously by the investment community. They often need to demonstrate exceptional market insight or extraordinary early traction to overcome this implicit age bias.

A fundamental issue is the pervasive lack of personal assets among teenagers. Most young individuals have not had sufficient time to accumulate significant savings or assets. A typical 16- or 18-year-old founder might possess only a few hundred or a few thousand dollars—derived from summer jobs or allowances—to inject into a business concept. This severe financial constraint limits the scope and scale of potential ventures, often forcing them to remain small-scale online operations or local service businesses. Research indicates that approximately 78% of all new entrepreneurs initially rely on personal savings to launch their businesses [24]. For teenagers, who possess minimal financial cushions, this implies that many are unable to launch at all, or can only do so on an extremely modest scale, without external capital. Even seemingly minor startup expenses, such as a few thousand dollars for website development, marketing, or initial inventory, can represent an insurmountable financial barrier.

Beyond monetary constraints, young founders often lack the established networks and business acumen that older entrepreneurs typically acquire over years of professional experience. They may not possess connections to potential investors, vital suppliers, or experienced industry mentors. This “network gap” not only complicates the process of securing funding but also makes navigating complex business aspects, such as legal incorporation, financial management, or grant applications, significantly more challenging. Older entrepreneurs can leverage their professional relationships with accountants, lawyers, and mentors, resources that are largely unavailable to most teenagers. This disparity means that young founders are often expected to achieve more with significantly less support, exacerbating the disadvantage of inadequate capital. The funding gap is often intertwined with this network gap, as investors are generally more inclined to fund individuals within their established networks, which rarely include 17-year-olds.

Furthermore, teenagers and their families often harbor understandable reservations about incurring debt or exposing substantial sums of money to the inherent risks of a new business venture. A failed startup could potentially jeopardize college savings or impose severe financial strain on a family. A Junior Achievement poll identified “fear of failure” as a top concern among teens contemplating entrepreneurship [25]. Unlike a founder in their 30s who may have a professional safety net or alternative career options, a teenager’s entire future lies ahead, amplifying the perceived stakes of such risks. This caution can lead to under-funding a business, where attempts to operate on minimal cash reserves invariably diminish its chances of success. It creates a vicious cycle: insufficient capital increases the likelihood of business failure, which in turn reinforces the fear of financial waste. Breaking this cycle often necessitates access to non-debt, low-risk funding sources, such as small grants or equity investments that do not require repayment if the venture does not succeed.

The collective impact of this funding gap is that numerous teen-led ventures either fail to materialize or remain constrained to a very small scale due to financial limitations. This represents a significant loss of potential innovation and economic contribution, as many promising ideas conceived by young innovators never reach their full potential. For society and policymakers, this situation serves as a compelling impetus to establish targeted funding channels—including small loans and grants—specifically designed to level the playing field for young entrepreneurs. For those teenagers who do manage to launch businesses without adequate financing, the journey can be exceptionally stressful, often involving the arduous balancing of academic responsibilities with startup demands, possibly while working a supplementary job to fund their venture, all without the financial buffer typically enjoyed by adult-run startups. Addressing these multifaceted challenges requires both systemic reforms—such as banks adjusting their lending criteria and governments guaranteeing youth loans—and grassroots support, including mentorship programs and incubators that guide young founders toward alternative financing models. The encouraging news is that awareness of this critical gap is growing, and significant initiatives are now emerging to tackle it effectively.

Creative Financing Options: Crowdfunding and Community Capital

The advent of new financial technologies and community-driven platforms has ushered in a new era of creative financing for young entrepreneurs, effectively sidestepping the traditional barriers posed by conventional lenders and investors. Crowdfunding, in particular, has emerged as a transformative mechanism for teenagers to raise capital, leveraging digital networks to connect with a broad base of potential backers.

Crowdfunding as a Game-Changer

In the past decade, crowdfunding has proven to be an exceptionally powerful funding route for young entrepreneurs who are typically ineligible for traditional financing. Platforms such as Kickstarter and Indiegogo, alongside equity crowdfunding portals like Crowdcube and Wefunder, enable teenagers to present their product or business concept online and secure modest sums of capital from a multitude of individual contributors. This approach entirely bypasses the often-insurmountable requirements of banks and venture capitalists. It has been particularly effective for consumer product ideas that resonate directly with the public. A notable example is Palmer Luckey, who, at just 19 years old, successfully crowdfunded nearly $2.5 million on Kickstarter for his Oculus Rift VR headset in 2012 [26]. This initial community funding propelled his project from a garage prototype into a legitimate company, eventually acquired by Facebook. Such success stories underscore that with a compelling narrative and the ability to mobilize a community, age becomes an inconsequential factor for backers.

Equity Crowdfunding for Startups

Beyond rewards-based crowdfunding, the rise of equity crowdfunding offers another significant avenue, allowing participants to invest small amounts in exchange for actual shares in the company. This legal innovation, which became widespread in many jurisdictions in the mid-2010s, significantly broadened access to capital for youth-led startups. Akshay Ruparelia, a 19-year-old from the UK, famously leveraged Crowdcube to secure £400,000 from approximately 500 individual investors for his online real estate startup [27]. This campaign not only provided critical capital but also propelled his company to a £12 million valuation and generated considerable media attention, all without relying on traditional venture funding. Equity crowdfunding offers a dual benefit: young founders gain capital and a built-in network of brand ambassadors, while supporters gain the potential for financial returns.

Social Media and Peer Support

Teenagers, being digital natives, adeptly utilize social media to bolster their crowdfunding campaigns and secure community-based financing. Many young founders initiate their fundraising by engaging their personal networks—friends, family, and local community—for seed funding, essentially a form of “micro-crowdfunding.” Platforms like Instagram, YouTube, and TikTok are instrumental in promoting their entrepreneurial journeys and soliciting support. A viral post or an engaging video can attract donations or investments from individuals worldwide who connect with the young founder’s vision. This grassroots financing strategy capitalizes on teenagers’ proficiency in online storytelling and networking, effectively mitigating a portion of the network gap that traditionally constrained youth fundraising efforts.

Lower Thresholds, Broader Reach

The inherent advantage of crowdfunding for young entrepreneurs lies in its distributed nature; rather than seeking a large sum from a single entity, they can accumulate funds in smaller increments ($20, $50, $100) from numerous individuals who believe in their idea. This significantly lowers the barrier to entry. A spirited teen entrepreneur with a promising concept can realistically raise several thousand dollars from classmates, community members, and even online strangers, whereas securing a $5,000 bank loan might prove impossible. Furthermore, successful campaigns not only provide financial resources but also validate market demand and cultivate an initial customer base. For young founders, managing a crowdfunding campaign serves as an invaluable learning experience in marketing, pitch development, and customer engagement. This democratization of capital access explains why global crowdfunding volume has recently soared into tens of billions of dollars annually [28].

Challenges and Cautions

Despite its benefits, crowdfunding is not without its difficulties. Teen founders must meticulously plan their campaigns, set realistic goals, and diligently fulfill their commitments to backers. Inexperience can lead to misjudging costs or timelines, resulting in project failure and public dissatisfaction. Additionally, most platforms require users to be 18 years or older to create an account, necessitating parental or guardian involvement for younger entrepreneurs. The competitive nature of crowdfunding also means that a project must possess exceptional content and promotional strategies to stand out. Nevertheless, many underage entrepreneurs have successfully navigated these challenges, leading some educational institutions to integrate crowdfunding into their entrepreneurship curricula as a practical first resort for capital acquisition.

Grants, Competitions, and Micro-Loans: Non-Traditional Funding Paths

Startup Contests for Teens

The past few years have seen a surge in business plan competitions, hackathons, and pitch contests specifically designed for young innovators. Programs like the Diamond Challenge, for example, offer significant prize pools (e.g., $100,000 in awards) for student-run ventures [29]. Organizations such as Junior Achievement host annual competitions where teenage teams present their startup ideas to judges, vying for cash prizes or scholarships. These events not only provide seed money, often ranging from a few hundred to several thousand dollars, but also invaluable coaching and feedback. For many teens, these competitions represent their first tangible opportunity to secure funding to kickstart a project. Such contests are crucial in identifying and nurturing high-potential young founders, offering initial capital and vital validation that can lead to further funding opportunities.

Youth Business Grants

Beyond competitions, various grants are explicitly designated for young entrepreneurs, offering non-repayable funds for promising ideas. These grants originate from diverse sources, including nonprofit foundations, government economic development agencies, and corporations sponsoring youth innovation. The Thiel Fellowship, for instance, provides $100,000 grants to select founders under 23 years old to support their ventures [30]. Similarly, municipal governments and development banks often run youth innovation challenges that award grants to teen-led social enterprises addressing community issues. These programs, while highly competitive, offer crucial financial support and often include mentorship components, effectively treating the startup endeavor as an educational pursuit worthy of funding.

Micro-Loans and Youth Credit Programs

Microfinance institutions, traditionally serving marginalized borrowers, have expanded their offerings to include young entrepreneurs. These micro-loans, ranging from a few hundred to several thousand dollars, are often supported by community organizations or government guarantees to mitigate risk. In Europe, a remarkable 89% of microfinance institutions now provide financing for youth-led ventures, underscoring the widespread adoption of this support mechanism [31]. Programs like Canada’s Futurpreneur and India’s PMYY scheme offer collateral-free loans accompanied by mentorship to young business owners. These programs typically feature more lenient qualification criteria, accepting business plans and potentially personal guarantors in lieu of traditional credit scores, combined with mandatory training for borrowers. While debt can be daunting for teenagers, these micro-loans can provide the necessary capital for equipment or initial inventory. Successful repayment also helps young entrepreneurs build a credit history, facilitating access to larger capital in the future.

School and University Incubators

Educational institutions are increasingly pivotal in facilitating creative financing for teen startups. Many high schools now offer entrepreneurship clubs or incubator programs that provide modest funding, such as $500 to $1,000 “seed grants” for top student business ideas. At the university level, accelerators like Y Combinator have developed student-focused tracks, allowing college-aged founders to apply and defer entry, ensuring that high-potential entrepreneurs are not overlooked due to academic commitments [32]. Some universities also operate venture funds that invest directly in student startups. This academic ecosystem enables a motivated teen founder to progress from a high school demo day win to a college incubator grant, and potentially to a funded accelerator, systematically scaling their venture with structured support.

Corporate and NGO Sponsorships

Corporate entities and non-governmental organizations (NGOs) are also significant contributors to youth innovation financing. Tech giants frequently sponsor coding competitions with cash awards or resources for winners. NGOs focused on economic development implement youth enterprise programs that combine small funding amounts with mentorship. These non-traditional avenues demonstrate that if a teen founder can exhibit passion and potential, diverse sources of capital can be aggregated. This often involves a mix-and-match approach—part grant, part prize winnings, part family loan—illustrating how many under-20 founders creatively finance their initial business endeavors.

Emerging Support Systems and Investment Trends for Teen Startups

The increasing recognition of teen entrepreneurial potential is not merely reflected in individual achievements but is increasingly embedded within the broader startup ecosystem through a proliferation of specialized support systems and evolving investment trends. This represents a systemic shift from viewing youth as a liability to recognizing it as a strategic asset in fostering innovation.

Youth-Focused Venture Funds

A significant development is the emergence of venture funds and angel networks specifically dedicated to backing young founders. Beyond student-run initiatives like Dorm Room Fund, which has made over 150 investments in student startups within five years [33], there are now dedicated funds such as A* Capital, co-founded by Kevin Hartz. This firm explicitly seeks to invest in teenage prodigies. The commitment of seasoned VCs to allocate significant portions of their portfolios to teen-led startups signals a profound change in investor perception. For instance, TechCrunch reported that A* Capital strategically invested approximately 20% of its fund in companies initiated by under-20 entrepreneurs [34]. Other initiatives, like General Catalyst’s Rough Draft Ventures, provide initial financial backing and guidance to college-aged (and occasionally high school) entrepreneurs, serving as crucial feeder systems for larger VC rounds. This trend suggests that youth is increasingly perceived as an advantage, offering fresh perspectives and early access to Gen Z consumer markets, rather than a deterrent.

Accelerators Adjusting for Age

Historically, premier startup accelerators, including Y Combinator and Techstars, featured few, if any, teenage participants. This is now changing. Y Combinator has adapted its programs to accommodate student founders, allowing them to apply early and defer participation until after graduation [35]. This strategy ensures that high-potential college-aged CEOs are not overlooked. Techstars has also engaged in youth hackathons and entrepreneurial bootcamps to cultivate a pipeline of young talent. Furthermore, the landscape is seeing the rise of teen-specific accelerators, such as Young Founders Lab and TartansXX (by Carnegie Mellon University), which provide tailored environments for under-18 innovators to develop their ideas with mentorship and seed funding. These programs often customize their content and scheduling to accommodate younger audiences, bridging the gap between student projects and viable businesses and making these teens more “investment-ready.”

Mentorship and Networks Scaling Up

Recognizing that young founders require guidance as much as capital, a multitude of new mentorship networks have blossomed. Nonprofits like Youth Business International, a global network operating in over 50 countries, connect young entrepreneurs with seasoned business mentors and sometimes facilitate access to loans. Online communities, including Slack groups, Discord channels, and forums dedicated to teen entrepreneurs, foster peer support and resource sharing. This expanding network empowers young founders to navigate challenges such as legal incorporation for minors, identifying teen-friendly investors, and balancing academic and entrepreneurial responsibilities, thereby accelerating their learning curve. For investors, this networked approach offers reassurance: teen founders integrated into robust mentor networks are often better prepared and have access to adult advisors for complex aspects like legal contracts or financial planning.

Changing Attitudes and Success Stories

High-profile success stories of youth-led businesses are gradually dismantling long-held skepticism in the investment community. When a teenager-founded startup achieves significant success—whether through a multi-million-dollar acquisition, like 21-year-old Catherine Cook’s MyYearbook for $100 million [44], or by reaching substantial revenue milestones—it garners media attention and shifts perceptions. Investors, who might have previously been hesitant, are now re-evaluating their stances and becoming more receptive to meeting young founders. This phenomenon, often termed the “Youthquake,” highlights how very young innovators are disrupting established industries, particularly in sectors such as social media, gaming, and the creator economy. The fear of missing out (FOMO) among funders is becoming a potent motivator: they are increasingly unwilling to overlook the next groundbreaking venture simply because its founders are still in their teens. While critics rightly emphasize the enduring importance of experience and management skills for scaling a company, the overarching trend indicates a growing inclusion of youth within the mainstream startup ecosystem.

Policy Support and Legal Reforms

Governments worldwide are beginning to acknowledge the necessity of adapting regulations to better support younger entrepreneurs. Some jurisdictions are actively exploring mechanisms to enable minors to register businesses or access grants with fewer administrative hurdles, often requiring guardian consent rather than full guardianship for every contractual agreement. The success of the UK’s Start Up Loans scheme, which has provided over £100 million to 18-24-year-old founders since 2012 [45], [46], has prompted discussions about extending similar support to under-18 founders through educational channels. Countries grappling with high youth unemployment are increasingly integrating entrepreneurship into broader youth empowerment initiatives. The EU’s “Youth Guarantee” includes provisions to assist young people in starting businesses, and organizations like the OECD offer guidance for policies that enhance access to finance for youth [47], [48]. As these policy recommendations evolve into concrete programs—from entrepreneurship training in schools to dedicated seed funding pools for young innovators—a more enabling environment is anticipated. This momentum suggests that within the next five years, it could become significantly easier for a talented 16- or 20-year-old to launch and scale their startup than it is today.

The convergence of these emerging support systems points towards a virtuous cycle: as more teen startups achieve success, more stakeholders are incentivized to invest in and support them, which, in turn, generates further successes. Looking ahead, it is plausible to foresee teen founders tackling increasingly ambitious ventures in deep technology or biotechnology, leveraging the scaffolding of university labs or corporate accelerator partnerships. Investors may launch funds exclusively dedicated to founders under 25. Advances in digital identity verification and contracting could also streamline legal processes, allowing minors to hold equity or receive funds in trust until they reach legal age, thereby smoothing out existing legal complexities. If the current trajectory continues, “funding future founders” will transcend a mere slogan to become an integrated and essential component of the startup finance landscape, ensuring that creative financing options are widely accessible to the next generation of entrepreneurs, irrespective of their age or background.

This comprehensive overview underscores that while significant challenges remain in accessing traditional capital, the ecosystem supporting teen entrepreneurship is rapidly evolving. The next sections of this report will delve deeper into specific financing mechanisms, successful models, and policy recommendations to further empower this generation of innovators.

2. The Rise of the Teen Founder: Surging Ambition and Digital Native Advantages

The entrepreneurial landscape is undergoing a profound transformation, driven significantly by the emergence of a new generation of innovators: the teen founder. Far from being a fringe phenomenon, the ambition to launch and lead businesses is surging among Generation Z, particularly in the United States and globally. This section delves into the unprecedented rise of the teen founder, exploring the multifaceted influences shaping their entrepreneurial aspirations, including the pervasive impact of technology, the ubiquity of social media, and the indelible marks left by a post-pandemic world. Understanding this seismic shift is crucial, as it outlines the potential implications for future innovation, economic growth, and the very fabric of global commerce. Teenagers today are not merely consumers of digital content; they are digital natives who intrinsically understand and leverage technology to create, connect, and commercialize. This innate familiarity with digital tools, coupled with a growing cultural embrace of youth-led innovation, has fostered an environment ripe for entrepreneurial exploration. The traditional pathways to success, often rooted in corporate employment, are increasingly being challenged by a generation that views self-employment and venture creation as not only viable but often preferable alternatives. This section will systematically explore the drivers behind this surge, the advantages cultivated by this generation, the persistent challenges they face, and the transformative potential they hold for the global economy.

2.1 Gen Z’s Entrepreneurial Surge: A New Era of Teen Startups

The current generation of teenagers, often referred to as Generation Z, exhibits an entrepreneurial mindset unparalleled by previous generations. Recent data unequivocally indicates that the aspiration to build and run a business is at an all-time high, painting a compelling picture of a future workforce dominated by founders rather than employees.

2.1.1 Record Levels of Interest and Shifting Career Paradigms

A stark illustration of this burgeoning ambition comes from a 2022 Junior Achievement survey, which revealed that a remarkable **60% of U.S. teens would prefer to start their own business rather than work a traditional job**1. This figure represents a substantial increase from just four years prior, when a similar survey in 2018 indicated that only 41% of U.S. teens considered entrepreneurship as a career option2. This nearly 50% increase in entrepreneurial preference within a short span signifies a profound cultural shift. Entrepreneurship is no longer seen as a niche or risky career choice but as a mainstream, aspirational path. This growing interest is not confined to the United States. Similar trends are visible on a global scale, where many Gen Z youth perceive entrepreneurship as a viable and attractive career option. This global surge is fueled by several factors, including:

- High-profile young CEO role models: The media frequently highlights the successes of young entrepreneurs who have achieved significant breakthroughs and financial independence, inspiring their peers.

- Startup pop culture: Entrepreneurship is increasingly glorified in popular media, making the startup world appear dynamic, innovative, and “cool” compared to traditional corporate structures.

- Accessibility of e-commerce and digital platforms: The democratizing effect of online marketplaces and digital tools has lowered the barrier to entry, enabling young individuals to launch ventures with minimal upfront investment and technical expertise.

This environment has normalized the idea of youth entrepreneurship, transforming it from a “fringe” concept to an attainable goal.

2.1.2 The Influence of Technology and Social Media

A cornerstone of the teen founder phenomenon is their intrinsic relationship with technology and social media. Gen Z has grown up in a perpetually connected world, making them true digital natives. This native understanding translates into significant advantages for entrepreneurial endeavors:

- Innate digital literacy: Unlike older generations who adopted technology, Gen Z was born into it. They are proficient in navigating complex digital ecosystems, understanding algorithms, and leveraging online tools for communication, marketing, and sales without formal training.

- Low-cost digital tools: The proliferation of accessible and often free digital tools—from website builders and graphic design software to video editing platforms and project management systems—means that teens can design products, create compelling content, and manage operations with minimal capital outlay.

- Direct-to-consumer models: Platforms like Shopify, Etsy, and various social commerce features within Instagram and TikTok allow teens to set up online stores and reach a global customer base directly, bypassing traditional retail channels and geographical limitations. This capability enables rapid market testing and iterative product development at a fraction of the cost associated with traditional business launches.

- Viral marketing and community building: Social media is not just a marketing channel; it’s a domain where Gen Z excels. They intuitively grasp how to create viral content, engage with online communities, and build a brand presence organically. A well-executed TikTok campaign or an engaging Instagram trend can provide unprecedented reach and customer acquisition at virtually no cost.

This technological fluency significantly lowers traditional barriers to entrepreneurship, fostering an environment where a teen’s startup could begin as an online fashion brand or a mobile application gaining traction through viral social media marketing. The ability to test ideas and iterate quickly with minimal financial risk encourages more teenagers to experiment with entrepreneurial ventures.

2.1.3 The Post-Pandemic Mindset

The global COVID-19 pandemic between 2020 and 2022 played an unexpected yet significant role in accelerating youth entrepreneurship. The disruptions caused by lockdowns, remote learning, and changes in traditional part-time job opportunities pushed many young people to adapt and innovate:

- Exploration of side hustles: With physical schools closed and traditional teen jobs (e.g., retail, food service) affected, many teenagers pivoted to online ventures. Surveys from 2021-2022 documented spikes in teens selling products online, offering virtual tutoring services, or monetizing hobbies through digital platforms like YouTube and Twitch.

- Development of practical skills: This period forced young individuals to acquire hands-on business skills, from managing online orders and customer service to digital marketing and financial tracking. These experiences instilled a sense of capability and self-reliance.

- Shift in career perceptions: The instability of traditional employment during the pandemic led many teens to question the perceived safety of corporate careers. For a significant cohort, creating their own job or business emerged as a more resilient and empowering pathway, offering greater control and flexibility. This fostered a desire for autonomy and innovation over traditional career stability.

The pandemic, therefore, served as both a catalyst and a proving ground, demonstrating to a generation that they possess the ingenuity and adaptability to forge their own economic destinies.

2.1.4 Global Variations in Youth Entrepreneurship

While the entrepreneurial spirit is broadly rising across Gen Z, its drivers and manifestations vary significantly across different regions, reflecting diverse socio-economic contexts.

- European Union: In the EU, approximately 40% of young people (aged 15-30) express a desire to be self-employed3. However, the actual rate of youth entrepreneurship remains significantly lower, with only about 7% being actively engaged as entrepreneurs3. This gap between aspiration and participation, highlighted in a 2023 finding, underscores the presence of structural barriers and a stronger preference for stable, traditional employment facilitated by robust social safety nets. Moreover, youth aged 20-29 constitute 18% of the EU workforce but only 8.2% of self-employed workers, indicating they are less than half as likely as older adults to run their own business4. This underrepresentation has remained consistent for over a decade, often attributed to older entrepreneurs possessing greater work experience, accumulated savings, and easier access to capital compared to their younger counterparts4.

- Emerging Economies: In stark contrast, youth entrepreneurship rates in emerging economies often tend to be higher, primarily driven by necessity. Where formal job opportunities are scarce, many young individuals resort to informal micro-businesses or gig economy work to generate income. For example, Sub-Saharan Africa exhibits some of the highest youth self-employment rates, often characterized by young people starting small, informal enterprises to meet immediate financial needs. Here, the primary driver is economic survival rather than opportunity and innovation, though both types of young founders can significantly benefit from enhanced access to capital to scale beyond subsistence.

The table below summarizes key differences in youth entrepreneurial drivers across developed and developing regions:

| Region Type | Primary Drivers of Youth Entrepreneurship | Characteristics of Ventures | Implications for Capital Access |

|---|---|---|---|

| Developed Nations (e.g., US, EU) | Opportunity, innovation, digital leverage, personal autonomy, aspiration for self-direction | Often tech-enabled, scalable, value-driven, diverse sectors (e-commerce, SaaS, creative) | Need for seed funding, grants, mentorship to grow innovative ideas beyond personal savings |

| Emerging Economies (e.g., Sub-Saharan Africa) | Necessity, lack of formal employment, income generation, community needs | Often informal, micro-businesses, local services, traditional crafts, agricultural entrepreneurship | Critical need for micro-loans, basic business training, support to formalize and scale from subsistence |

2.1.5 Implications for Innovation and Economic Growth

The surging entrepreneurial ambition among Gen Z carries significant implications for future innovation and economic growth. We are witnessing the emergence of millions of “future founders” who, if adequately supported, can inject new dynamism into economies worldwide.

- Educational system response: Educational institutions, from high schools to universities, are increasingly recognizing this trend. They are incorporating entrepreneurship courses into curricula, organizing startup competitions, and highlighting local and national success stories. This proactive engagement will further nurture young talent and provide foundational skills.

- New market opportunities: For established businesses and investors, this trend opens doors to new opportunities. Tomorrow’s breakout startup could well be founded by a 16- or 17-year-old today, requiring innovative approaches to scouting talent and early-stage investment.

- Need for robust support systems: To harness this potential fully, stronger support systems are essential. Mentorship programs, legal frameworks tailored for minors in business, and accessible funding mechanisms are critical. Without these, the enthusiasm of young entrepreneurs risks being stifled by preventable obstacles such as lack of knowledge or, most crucially, capital.

The trajectory points towards a future where youth-driven startups will increasingly enter the economy, spurring innovation, creating jobs, and potentially redefining industry landscapes, provided they are properly nurtured and supported.

2.2 The Capital Gap: Funding Challenges Facing Teen Founders

Despite the surging entrepreneurial ambition, a significant chasm exists between aspiration and participation, primarily due to the substantial financial barriers faced by young founders. Access to capital is consistently identified as the primary hurdle, underscoring systemic issues within traditional financing structures that disadvantage minors.

2.2.1 High Barriers at the Bank: The Inaccessibility of Traditional Loans

For most teenagers, traditional financial institutions like banks represent an insurmountable barrier when seeking startup capital. The financial infrastructure is simply not designed to accommodate young individuals, who typically lack the prerequisites for conventional loans:

- Absence of credit history: Teenagers rarely have an established credit history, which is a fundamental requirement for banks to assess creditworthiness. Without a record of managing debt responsibly, loan applications are almost automatically rejected.

- Lack of collateral: Most minors do not possess significant assets that could serve as collateral for a business loan. This absence of tangible security further exacerbates their inability to access conventional financing.

- Limited legal capacity: In many jurisdictions, individuals under the age of 18 are considered minors and lack the legal capacity to enter into binding contracts, including business loans or credit lines, without a co-signer (typically a parent or legal guardian). This legal constraint forces even promising young entrepreneurs to rely on adult intermediaries, adding complexity and potential friction.

These structural barriers mean that banks and conventional lenders effectively close their doors to teen founders. Even basic necessities such as opening a dedicated business bank account or securing a business credit card often necessitate a parent or guardian’s co-signature. Consequently, young entrepreneurs are compelled to explore alternative funding avenues or significantly restrict the scale and ambition of their ventures.

2.2.2 Investor Skepticism and Age Bias in Venture Capital

The world of venture capital (VC) and angel investment, while often portrayed as forward-thinking, has historically shown reluctance to back very young founders. This skepticism stems from several common concerns:

- Lack of business experience: Investors often prioritize founders with a proven track record, believing that extensive experience translates into better decision-making and operational execution. Teenagers, by virtue of their age, typically lack this professional background.

- Unproven ability to execute: Beyond initial ideas, investors assess a team’s capability to execute a business plan, manage finances, lead employees, and navigate market challenges. These are skills that are often perceived to mature with age and experience.

- Distractions from school or parental constraints: The demands of formal education, parental oversight, and the general social developmental stage of adolescence are often seen as potential distractions that could impede a startup’s progress and the founder’s full commitment.

The average age of a funded startup founder is around the mid-30s, highlighting a systemic preference among investors for more experienced entrepreneurs. While there are iconic exceptions like Mark Zuckerberg, who founded Facebook at 19, these are generally viewed as outliers rather than the norm. Teen CEOs frequently face an uphill battle to be taken seriously, often needing to demonstrate extraordinary traction, unique domain expertise, or highly innovative technology to overcome the pervasive age bias. This means that while older founders can gain funding for ideas with potential, teen founders often need to prove substantial progress or even profitability before they are considered investment-ready.

2.2.3 Lack of Personal Assets: The Thin Financial Cushion

Most teenagers have not had sufficient time to build substantial personal savings or acquire significant assets. This means that they operate with an extremely limited personal capital base, typically comprising a few hundred or a few thousand dollars from summer jobs, allowances, or gifts. This minimal financial cushion severely constrains the scope and scale of their entrepreneurial aspirations.

- Bootstrap dependency: A 2019 study revealed that a significant majority—78% of new business owners—did not seek any outside financing in their first year, relying instead on personal savings, funds from family and friends, or income from a primary job to sustain their early ventures5. While this “bootstrapping” approach is common across all age groups, it is particularly challenging for teens who possess the thinnest financial reserves.

- Constrained scope: This reliance on meager personal funds often means teen-led startups remain very small-scale, frequently limited to online ventures or local service businesses that require minimal initial investment.

- Significant hurdle of startup expenses: Even relatively minor startup expenses—such as a few thousand dollars for website development, initial marketing efforts, or inventory—can become insurmountable obstacles without external funding. This reality means many potentially innovative ideas never progress beyond conceptualization due to the absence of seed capital.

The limited personal financial capacity of teens amplifies the funding gap, making them disproportionately dependent on external support or highly innovative financing solutions.

2.2.4 Resource and Network Gaps

Beyond direct financial constraints, young founders often encounter significant resource and network gaps that further impede their entrepreneurial journey:

- Limited professional network: Unlike older entrepreneurs who have spent years building professional relationships, teenagers typically lack connections to potential investors, experienced suppliers, industry experts, or seasoned mentors. This deficit makes it challenging to find backers who often invest based on personal recommendations or established relationships.

- Business acumen deficit: Navigating complex business processes such as business banking, legal incorporation, intellectual property protection, or grant applications requires a level of business acumen that is usually developed with experience. Older entrepreneurs can leverage accountants, lawyers, or mentors for guidance, but teens often lack access to such resources.

- Amplified funding challenges: The network gap directly contributes to the funding gap. Investors are more likely to fund individuals within their established networks, which rarely includes 17-year-olds. Without these connections, young founders struggle to even get their ideas in front of potential funders.

Essentially, young founders are often asked to achieve more with significantly fewer resources and less established support, which magnifies the disadvantage created by their lack of capital.

2.2.5 Fear of Debt and Risk Aversion

The inherent risks associated with starting a business are particularly daunting for teenagers and their families, leading to a natural aversion to debt and high-stakes investments:

- High personal stakes: For a teenager, a failed venture could lead to the depletion of college savings, significant family financial strain, or a sense of personal failure at a formative age. Unlike more mature entrepreneurs who might have a financial safety net or alternative career options, a teen’s entire future often feels dependent on the success of their first venture.

- Fear of failure: A Junior Achievement poll identified “fear of failure” as a top concern among teens considering entrepreneurship6. This fear is exacerbated by the lack of a financial cushion and the perceived permanence of early career decisions.

- Under-funding trap: This risk aversion can lead to a vicious cycle where businesses are under-funded in an attempt to minimize financial exposure. Trying to operate on minimal cash significantly increases the likelihood of failure, thereby validating the initial fear of wasting money.

Breaking this cycle often requires access to non-debt, low-risk funding sources, such as grants or equity investments that do not require repayment if the venture does not succeed. These funding types reduce the financial burden on young founders and encourage greater experimentation without extreme personal risk.

2.2.6 Implications of the Funding Gap

The cumulative effect of these challenges is that a vast number of promising teen-led ventures never materialize, or they remain perpetually small-scale, constrained by financial limitations. This represents a significant loss of potential innovation, economic growth, and the development of future leaders.

- Lost innovation: Many excellent ideas conceived by young innovators simply do not receive the necessary resources to come to fruition, resulting in missed opportunities for societal and economic benefit.

- Strain on young founders: Those who do attempt to launch without adequate funding face immense stress, balancing academic commitments with the demanding realities of building a business, often while working side jobs to self-fund their ventures.

- Policy imperative: For policymakers and society at large, this funding gap serves as a powerful motivator to create targeted, youth-friendly funding channels (e.g., small loans, grants, mentorship programs) to level the playing field.

Addressing these challenges requires both systemic changes within financial institutions (e.g., banks adjusting lending criteria, governments guaranteeing youth loans) and grassroots support through mentorship and incubators that guide young founders toward alternative financing solutions. While the problem is significant, growing awareness has led to the emergence of new initiatives designed to bridge this critical gap, which will be explored in subsequent sections.

2.3 Creative Financing Options: Crowdfunding and Community Capital

In response to the formidable barriers posed by traditional financing, creative financing options have emerged as critical enablers for teen founders. Among these, crowdfunding and community capital stand out as game-changers, leveraging digital platforms and social networks to provide capital access previously unattainable for young entrepreneurs.

2.3.1 Crowdfunding as a Game-Changer

Crowdfunding, the practice of raising small amounts of money from a large number of people, has revolutionized access to capital for young entrepreneurs. Platforms like Kickstarter, Indiegogo, and equity crowdfunding portals (e.g., Crowdcube, Wefunder) allow individuals to pitch their ideas directly to a global audience, bypassing traditional gatekeepers like banks and venture capitalists.

- Bypassing traditional institutions: Crowdfunding enables teens to directly solicit funds, often for product pre-orders, donations, or equity stakes, thus circumscribing the need for credit history, collateral, or stringent legal contracts typically required by banks.

- Proof of market demand: A successful crowdfunding campaign not only provides capital but also serves as powerful validation of market demand for a product or service. This initial success can then attract further investment and partnerships.

- Notable Success Story: Oculus VR. Palmer Luckey, a 19-year-old, launched a **Kickstarter campaign** in 2012 for his Oculus Rift VR headset. He successfully raised **nearly $2.5 million**, significantly exceeding his $250,000 goal7. This community funding allowed him to develop developer kits and refine the technology. Just 20 months later, Facebook acquired Oculus for approximately **$2 billion**, making Luckey, at 21, a tech visionary and demonstrating the immense potential of crowdfunded ventures to scale into billion-dollar enterprises.

This example shows that if a compelling story can be told, and a community rallied, age becomes irrelevant to backers. Crowdfunding thus democratizes access to capital, turning strong ideas and community support into financial leverage.

2.3.2 Equity Crowdfunding for Startups

Beyond rewards-based crowdfunding, equity crowdfunding allows numerous small investors to collectively fund a startup in exchange for a share of ownership. Legal frameworks in many jurisdictions began to permit this in the mid-2010s, opening a new avenue for youth-led ventures.

- Direct investment from the public: Equity crowdfunding empowers the general public to become investors, enabling startups to raise capital without relying on a select group of angel investors or venture capitalists.

- Akshay Ruparelia’s Doorsteps.co.uk: A striking example is Akshay Ruparelia, who at 19 years old, raised **£400,000 (approximately $530,000 USD)** from around 500 individual backers via the Crowdcube equity crowdfunding platform for his online real estate startup, Doorsteps.co.uk8. This campaign, when Ruparelia founded the company while still in high school, valued his business at £12 million. This allowed him to secure substantial capital without resorting to traditional investors or banks, simultaneously generating significant media attention (“Britain’s youngest millionaire”).

- Win-win scenario: Equity crowdfunding offers a dual benefit: young founders acquire essential capital and gain a built-in network of brand ambassadors, while investors get the opportunity to share in the potential exponential growth of promising early-stage companies.

2.3.3 Social Media and Peer Support: The Network Advantage

Teenagers, as quintessential digital natives, are adept at leveraging social media and their extensive online networks to drive crowdfunding efforts and establish community-based financial support.

- Leveraging personal networks: Many young founders initiate their fundraising by engaging their immediate social circles—friends, family, and local community members—a form of “micro-crowdfunding” that provides initial seed capital and momentum.

- Platform-specific engagement: Teens instinctively use platforms like Instagram, YouTube, and TikTok to document their entrepreneurial journeys, promote their products, and solicit support from a broader audience. A viral social media post can attract donations or investments from around the globe, connecting young entrepreneurs with individuals who resonate with their mission.

- Overcoming network gaps: This grassroots approach effectively addresses the traditional network gap that limits young founders’ access to capital. By transforming social capital (followers, community goodwill) into financial capital, talented teens can circumvent the need for established connections in the investment world.

This innate ability to harness online storytelling and community engagement strengthens the fundraising capabilities of young entrepreneurs.

2.3.4 Lower Thresholds, Broader Reach

The inherent advantage of crowdfunding for teens lies in its ability to accumulate capital through numerous small contributions, rather than requiring large sums from single institutions.

- Democratization of capital: Instead of needing a multi-thousand-dollar loan from a bank, a teen entrepreneur can realistically raise several thousand dollars by collecting $20, $50, or $100 contributions from classmates, community members, and internet strangers who believe in their vision. This low threshold makes it possible for many more ventures to launch.

- Market validation and customer acquisition: Successful crowdfunding campaigns not only generate funds but also provide tangible proof of market demand and an early customer base. This dual benefit transforms fundraising into a valuable learning experience in marketing, pitching, and customer engagement for young founders.

- Explosive Growth: The global crowdfunding market experienced significant expansion, generating **$17.4 billion in funding in 2021** and projecting a surge to **$43.5 billion by 2028**910. This remarkable growth of approximately 150% within seven years underscores crowdfunding’s growing mainstream acceptance and its potent role in opening capital access for diverse entrepreneurial profiles, including teens.

2.3.5 Challenges and Cautions in Crowdfunding

While crowdfunding offers immense potential, it is not without its difficulties:

- Campaign management: Successful crowdfunding requires meticulous planning, realistic goal setting, and effective communication to fulfill promises to backers. Inexperience can lead to misjudging costs or timelines, potentially resulting in project failures and public backlash.

- Age restrictions: Most crowdfunding platforms require users to be at least 18 years old to create campaigns. This necessitates parental or guardian involvement for very young entrepreneurs, who may need an adult to formally launch and manage the campaign on their behalf.

- Competition and visibility: The crowdfunding landscape is highly competitive, with thousands of campaigns vying for attention. Teen projects must possess a compelling narrative, high-quality content, and effective promotional strategies to stand out.

Despite these challenges, countless underage entrepreneurs have successfully leveraged community funding. The trend is so robust that some high schools have begun integrating crowdfunding into their entrepreneurship curricula, teaching students an invaluable skill for the modern startup ecosystem.

2.4 Grants, Competitions, and Micro-Loans: Non-Traditional Funding Paths

Beyond crowdfunding, a growing ecosystem of non-traditional funding mechanisms—including grants, business plan competitions, and micro-loans—is specifically designed to support young entrepreneurs who struggle with conventional financing. These avenues provide crucial capital, mentorship, and validation, facilitating the journey from idea to viable business.

2.4.1 Startup Competitions for Teens

Business plan competitions, hackathons, and pitch contests explicitly targeting young innovators have become prevalent. These events offer more than just financial prizes; they provide invaluable experience, mentorship, and networking opportunities.

- Seed money and validation: Competitions like the **Diamond Challenge** offer substantial prize pools, such as $100,000 in awards, for student-run ventures11. Organizations like Junior Achievement also host annual contests where teen teams pitch their startups for cash prizes or scholarships. Winning a competition provides crucial seed money (ranging from a few hundreds to tens of thousands of dollars) that can kickstart a project.

- Coaching and feedback: Participants benefit from structured coaching, feedback from experienced judges, and an opportunity to refine their business models. This process is often as valuable as, if not more important than, the monetary prize itself.

- Exposure and connections: These events expose young founders to potential mentors, investors, and fellow entrepreneurs, helping them build essential networks that are typically out of reach for their age group. The prestige of winning a reputable competition can significantly boost a startup’s credibility.

Such competitions serve as a vital entry point for many teens to secure their first round of funding and gain practical entrepreneurial experience.

2.4.2 Youth Business Grants

Grants represent a highly attractive funding option for young entrepreneurs because they are non-repayable, meaning they do not create debt or dilute equity. These grants are often provided by various entities:

- Nonprofit foundations and government agencies: Many foundations and government economic development agencies earmark grants specifically for youth innovation, often focusing on social impact or technological advancements.

- Corporate sponsorships: Corporations, seeking to foster future talent or align with social responsibility initiatives, also offer grants for youth-led projects.

- The Thiel Fellowship: A prominent example is the **Thiel Fellowship**, which awards **$100,000 grants** to selected founders under the age of 23, encouraging them to bypass traditional college education to focus fully on building their companies12. This non-dilutive funding, coupled with mentorship, has supported over 200 young founders globally and produced several notable startups.

- Other initiatives: Similarly, the 776 Fellowship, established by Reddit co-founder Alexis Ohanian, provides $100,000 grants to young innovators working on ambitious “moonshot” projects. These programs treat entrepreneurship as a valuable educational pursuit, funding it without the expectation of equity repayment.

While competitive, these grant programs provide essential runway, allowing young founders to develop their ideas without the immediate pressure of financial returns or debt repayment.

2.4.3 Micro-Loans and Youth Credit Programs

Microfinance, traditionally serving marginalized entrepreneurs in developing countries, has expanded its scope to include young entrepreneurs globally.

- Small-scale, accessible loans: Micro-loans typically range from a few hundred to a few thousand dollars, designed to cover initial setup costs like equipment or inventory. They are often provided by microfinance institutions (MFIs) or credit unions, sometimes backed by government guarantees to mitigate risk.

- Widespread support in Europe: A 2023 report indicated that **89% of microfinance institutions in Europe now provide financing to young entrepreneurs**13. This demonstrates a significant increase in dedicated support for youth-led ventures, often combining easier qualification criteria (e.g., accepting a business plan and a personal guarantor instead of a credit score) with mandatory business training.

- Government initiatives: Programs like the UK’s Start Up Loans programme, a government-backed scheme, have delivered over **15,000 micro-loans totaling £100 million** to 18-24-year-old entrepreneurs since 201214. These low-interest loans (averaging £5k-£10k) target young individuals unable to secure conventional bank credit, proving the efficacy of policy support for youth business financing. Similar initiatives exist in Canada (Futurpreneur) and India (PMYY scheme), offering collateral-free loans and mentorship.

Micro-loans serve as a critical lifeline, providing essential seed capital and an opportunity for young entrepreneurs to build a credit history, paving the way for larger funding rounds in the future.

2.4.4 School and University Incubators

Educational institutions are increasingly becoming pivotal in fostering and creatively funding teen startups.

- High school entrepreneurship programs: Many high schools now offer entrepreneurship clubs or incubator programs, often providing seed grants ranging from $500 to $1,000 for promising student business ideas developed during a semester-long course.

- University accelerators and venture funds: At the university level, programs like **Y Combinator** have introduced student-focused batches, allowing college-aged (and even some gap-year high school) founders to defer admission while receiving funding and mentorship15. Some universities run dedicated venture funds that invest in student-led startups, sometimes taking equity. University-hosted startup demo days also allow student entrepreneurs to pitch for funding from alumni donors.

This academic ecosystem enables a gradual scaling of support, from initial high school grants to sophisticated university-affiliated accelerators, providing structured pathways and resources at each stage of a young founder’s development.

2.4.5 Corporate and NGO Sponsorships

Large corporations and non-governmental organizations (NGOs) also contribute significantly to financing youth innovation through various sponsorship models.

- Competitive awards and resources: Tech giants sponsor coding competitions for teens, offering cash prizes, resources, and even mentorship. NGOs focused on economic development often administer youth enterprise programs that bundle small funding amounts with extensive mentorship.

- Social impact challenges: The U.N. and development banks, for instance, have sponsored youth entrepreneurship challenges in emerging markets, awarding grants (e.g., $10,000) to young social entrepreneurs addressing critical issues like clean water or education.

- Media exposure: Television programs like “Shark Tank” (and its international equivalents) feature teen entrepreneurs, and even if they don’t secure on-air investments, the resulting media exposure often leads to off-screen funding or partnerships.

These diverse, less conventional avenues highlight that passionate and potential-rich teen founders have multiple non-traditional sources to piece together initial capital, often mixing grants, prize winnings, and family support.

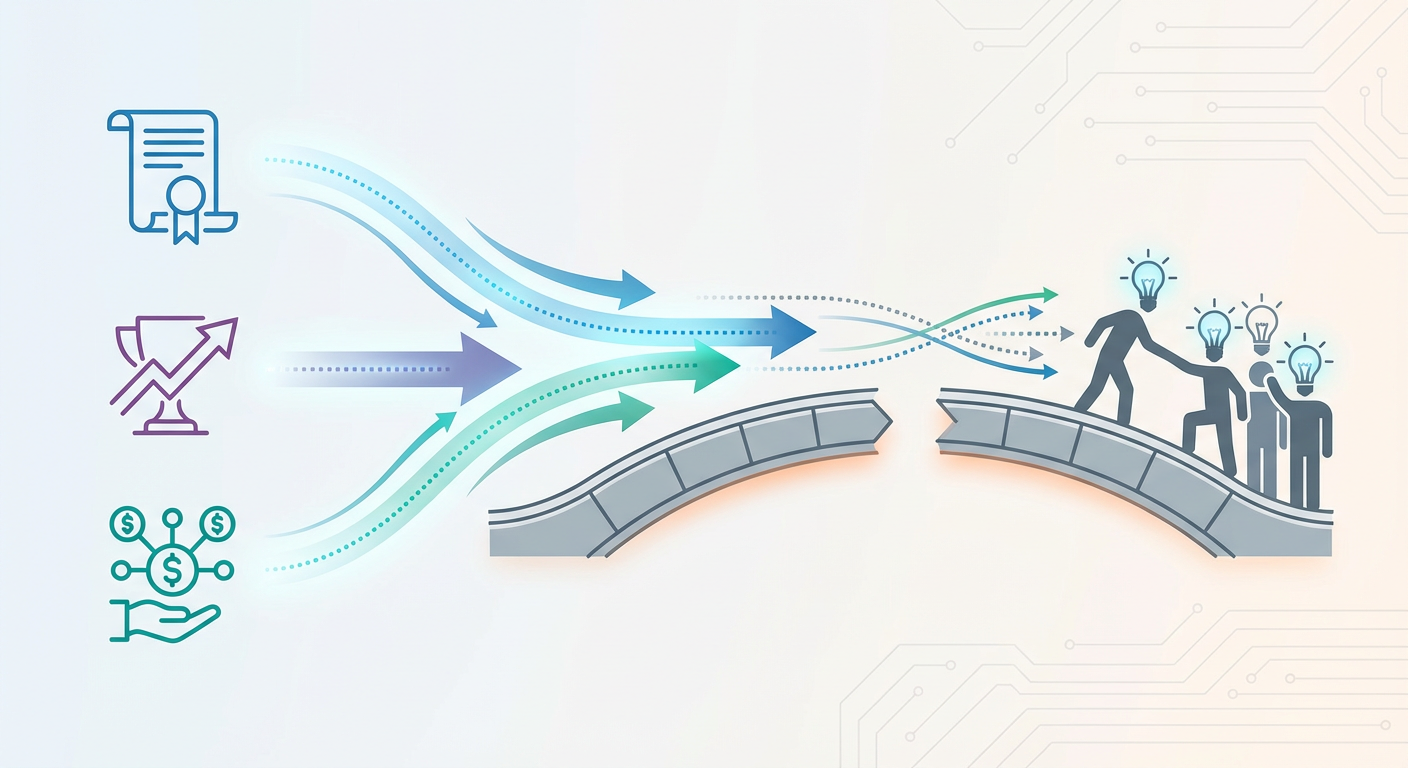

2.4.6 Building Credibility through Milestones

A crucial byproduct of these non-traditional funding mechanisms is the opportunity for young entrepreneurs to build significant credibility. Winning a respected competition, receiving a grant, or completing a recognized incubator program signals to future investors and lenders that a teen’s venture is serious, validated, and de-risked. This external validation makes it easier to secure subsequent meetings with angel investors or launch successful crowdfunding campaigns. These creative financing options not only inject initial capital but also serve as vital stepping stones toward attracting larger funding rounds. Stakeholders, from educational institutions to governments, are increasingly scaling these successful models, recognizing that supporting youth-led businesses is a strategic investment in future economic growth and innovation.

2.5 Emerging Support Systems and Investment Trends for Teen Startups

The landscape of support and investment for teen startups is rapidly evolving, driven by changing attitudes, recognition of their unique advantages, and the emergence of specialized funding mechanisms. This section details the burgeoning systems designed to nurture and fund the next generation of entrepreneurs.

2.5.1 Youth-Focused Venture Funds and Angel Networks

A significant shift in the investment community is the rise of venture capital funds and angel networks specifically targeting young founders. This marks a departure from historical biases against youthful entrepreneurs.

- Specialized Funds:

- Dorm Room Fund (DRF): Pioneering student-run venture fund, backed by First Round Capital, has made over 326 investments in student-founded startups, proving the viability of investing in young talent1617. Their portfolio companies have collectively raised over $300 million in follow-on capital, demonstrating the multiplier effect of early-stage support18.

- A* Capital: Co-founded by veteran VC Kevin Hartz, A* Capital has notably allocated approximately **20% of its fund to startups led by teenagers**19. This unprecedented commitment reflects a growing belief among seasoned investors that young entrepreneurs, particularly in rapidly evolving tech sectors like AI, gaming, and social apps, often possess unique insights and a competitive edge due to their native understanding of emerging trends.

- Rough Draft Ventures: General Catalyst’s initiative provides small checks and strategic guidance to college- and high school-aged entrepreneurs, acting as a crucial feeder system into larger VC rounds.

- Rationale for Investing in Youth: Investors are increasingly recognizing youth not as a liability but as an asset. Young founders often bring fresh perspectives, an intuitive grasp of Gen Z consumer markets, and unparalleled adaptability to new technologies. This shift indicates a paradigm change where exceptional youth are actively scouted and supported.

2.5.2 Accelerators Adjusting for Age

Historically, prestigious startup accelerators like Y Combinator and Techstars primarily selected older, more experienced founders. This trend is now evolving, with accelerators making concerted efforts to accommodate and attract younger talent.

- Y Combinator’s Student Program: YC has launched a dedicated program for student founders, allowing them to apply early and defer their enrollment or take a gap year, effectively ensuring that high-potential college-aged CEOs are not missed or forced to drop out without structured support15.

- Youth-focused Bootcamps and Incubators: Techstars has implemented youth hackathons and entrepreneurial bootcamps, creating pipelines for younger innovators. Moreover, specialized teen-only accelerators, such as Young Founders Lab and TartansXX (by Carnegie Mellon University), provide bespoke environments for under-18 innovators. These programs tailor mentorship, scheduling, and legal guidance to address the specific needs of young founders, making them “investment-ready” while navigating academic commitments.

These adjustments help bridge the critical gap between conceptual student projects and viable commercial ventures, preparing young entrepreneurs for success.

2.5.3 Scaling Mentorship and Networks

Recognizing that guidance is as crucial as capital, robust mentorship networks are expanding their reach to young founders.

- Formal Networks: Organizations like **Youth Business International** (a global network active in over 50 countries) connect young entrepreneurs with seasoned business mentors and often provide access to micro-loans.

- Peer-to-Peer Communities: Online platforms such as Slack groups, Discord communities, and dedicated forums have emerged, facilitating peer support and knowledge exchange among teen entrepreneurs. These communities allow young founders to share advice on challenges like navigating incorporation as a minor, approaching teen-friendly investors, or balancing academic life with startup demands.

- Alumni Networks: Alumni of programs like the Thiel Fellowship often form informal support structures, providing mentorship and resources to new fellows.

This growing network effect provides invaluable guidance and significantly accelerates the learning curve for young founders, making them more prepared and attractive to potential investors through the presence of adult advisors for legal, financial, and strategic matters.

2.5.4 Changing Attitudes and the Impact of Success Stories

High-profile success stories of youth-led businesses are progressively dismantling long-held skeptical attitudes towards young entrepreneurs.

- Inspiring Examples:

- Nick D’Aloisio (Summly): At 17, Nick sold his AI news-summary app, Summly, to Yahoo for **$30 million** in 201320. This transaction made international headlines and proved that age is no barrier to achieving significant exits.

- Catherine Cook (MyYearbook): Co-founded a social network at 15, which was later acquired for **$100 million** when she was 2121.

- Akshay Ruparelia (Doorsteps.co.uk): Raised £400,000 via equity crowdfunding at 19, valuing his proptech company at £12 million a year after its high school inception8.

- Shubham Banerjee (Braigo Labs): At 13, he secured venture funding from Intel Capital for his low-cost Braille printer prototype22.

- Investor Reassessment: Such achievements create a “fear of missing out” (FOMO) among investors, prompting them to re-evaluate their criteria and become more open to meeting and backing young founders. In industries driven by rapid technological change (e.g., social media, gaming, AI), young innovators often hold a distinct advantage due to their innate understanding of emerging trends and user behaviors.

- Cultural Shift: These narratives contribute to a broader cultural acceptance and even celebration of young CEOs, further encouraging entrepreneurial endeavors among Gen Z.

While some critics caution against the over-glamorization of youth entrepreneurship, emphasizing the continued importance of experience and management skills, the overall trend points towards greater inclusion and recognition of youth in the startup ecosystem.

2.5.5 Policy Support and Legal Reforms

Governments and regulatory bodies are beginning to acknowledge the need for policy adjustments to better support young entrepreneurs.

- Regulatory Ease: Discussions are underway in various jurisdictions to simplify processes for minors to register businesses or access grants, potentially requiring parental consent without full guardianship on every legal document.

- Government-backed schemes: The success of programs like the UK’s Start Up Loans scheme, which has invested over £100 million in 18-24-year-old entrepreneurs, has prompted consideration for extending similar support to under-18 founders through educational channels14.

- Youth Empowerment Initiatives: Countries grappling with high youth unemployment are increasingly integrating entrepreneurship into broader youth empowerment strategies. The EU’s “Youth Guarantee” includes provisions to help young people start businesses, and organizations like the OECD continuously provide guidance for policies aimed at improving access to finance for youth.

As these policy discussions translate into concrete programs—ranging from dedicated entrepreneurship training in schools to specialized seed funding pools—the environment for teen founders will become increasingly enabling.

2.5.6 Future Outlook: A Reinforcing Cycle of Innovation

The confluence of these emerging support systems suggests a powerful reinforcing cycle: As more teen startups succeed, more public and private stakeholders are incentivized to invest in and support them, which in turn fosters even greater success. The trajectory is clear:

- Broader Ambitions: We can anticipate young founders tackling increasingly complex and ambitious fields, including deep tech and biotechnology, leveraging academic collaborations or corporate accelerator partnerships.

- Specialized Investment Vehicles: The emergence of venture funds exclusively for founders under 25 may become more common.

- Legal and Digital Infrastructures: Advancements in digital identity and smart contracts could streamline legal processes, allowing minors greater autonomy in business ownership and financial management (e.g., funds held in trust until legal age).

If these trends continue, “funding future founders” will transcend a mere slogan to become an integral, easily accessible component of the global startup finance landscape. The next decade promises a dynamic era where creative financing options are widely available to the next generation of entrepreneurs, irrespective of age or background, driving unprecedented innovation and economic vibrancy. The integration of technology, a post-pandemic entrepreneurial drive, and responsive support systems are positioning teen founders to be significant engines of future global growth. This burgeoning ecosystem necessitates continued research into the specific mechanisms and best practices for supporting these young visionaries. — The subsequent section will delve deeper into the specific financial tools and mechanisms that are effectively bridging the capital gap for teen founders, examining the practical application and impact of creative financing options in greater detail.

3. The Capital Gap: Traditional Financing Hurdles for Young Entrepreneurs