The Role of Financial Literacy and Early Investment in Scaling Youth-Led Ventures

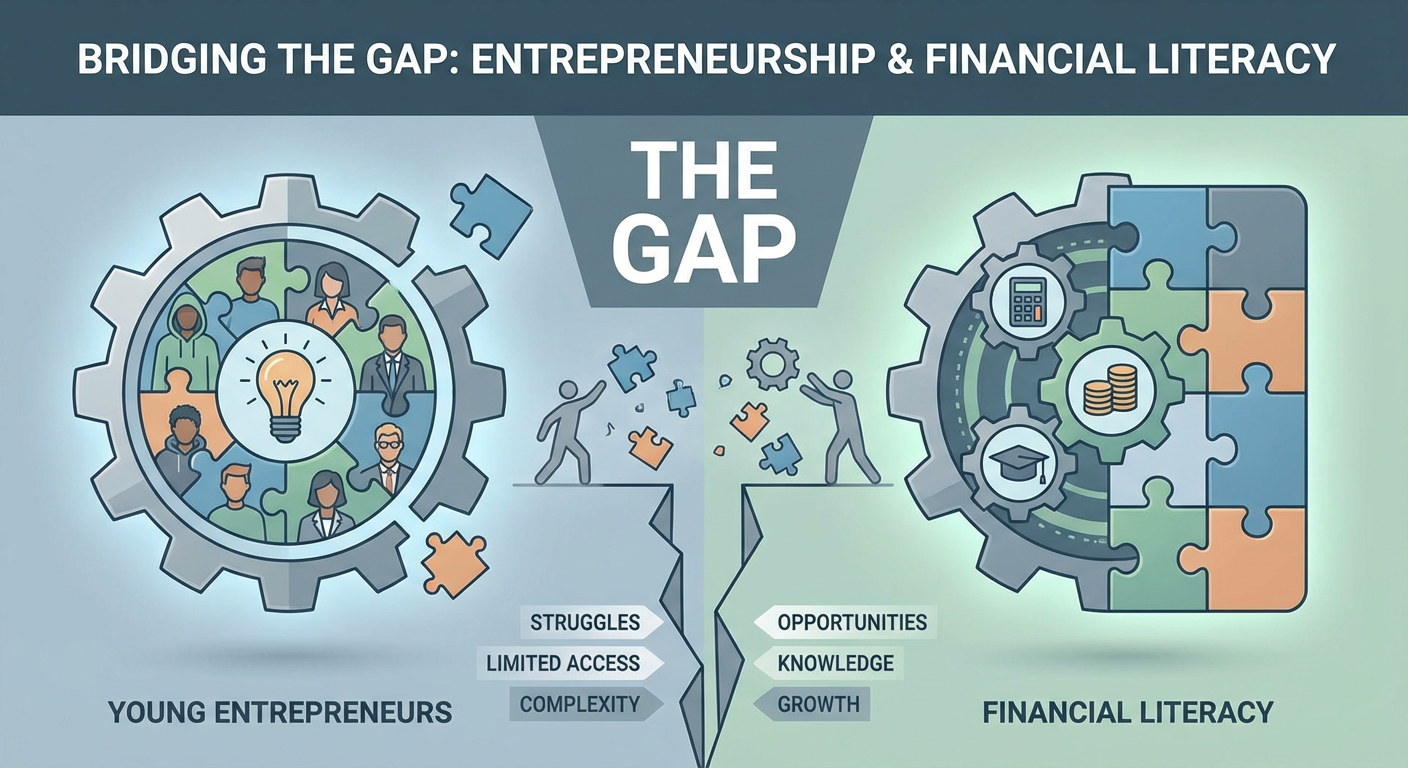

The global economic landscape is undergoing a profound transformation, driven in part by a burgeoning entrepreneurial spirit among young people. This shift presents both immense opportunities and significant challenges for the next generation of business leaders. This comprehensive research report delves into the critical factors influencing the success and scaling of youth-led ventures, with a particular focus on the intertwined roles of financial literacy and early investment. We examine the current surge in youth entrepreneurship, underscore the pervasive financial literacy gap, highlight the critical hurdles related to early-stage funding, and propose holistic solutions encompassing education, mentorship, and access to capital to nurture this vital economic engine.

Our findings reveal a landscape characterized by unprecedented enthusiasm among young individuals to forge their own paths, fueled by a desire for autonomy and innovation. However, this ambition is frequently met with a significant deficit in foundational financial knowledge and systemic barriers to accessing crucial startup capital. These twin challenges often predicate the early stagnation or failure of promising youth-led enterprises. This report distills the most impactful data points and insights, presenting a clear picture of the current state, the underlying problems, and the strategic interventions required to effectively transition youth-led ventures from compelling concepts to sustainable, cash-flow-positive entities capable of driving economic growth and job creation.

Key Takeaways

- Nearly three-quarters of Gen Z aspire to entrepreneurship, fueled by both ambition and necessity.

- A vast financial literacy gap persists: only 7% of 18–25-year-olds are financially literate.

- Financially savvy founders are 22% more likely to secure funding, highlighting investor preference.

- 38% of startup failures are due to running out of cash or failing to secure new capital.

- Many young entrepreneurs bootstrap using personal savings, limiting growth and increasing risk.

- 82% of small businesses fail due to cash flow problems, stressing the importance of financial acumen.

- Education and mentorship are crucial interventions, with 67% of young entrepreneurs citing insufficient financial knowledge.

1. Executive Summary

The global economic landscape is undergoing a profound transformation, driven in part by a burgeoning entrepreneurial spirit among young people. This shift presents both immense opportunities and significant challenges for the next generation of business leaders. This Executive Summary provides a high-level overview of the key findings from our comprehensive research into the factors influencing the success and scaling of youth-led ventures, with a particular focus on the intertwined roles of financial literacy and early investment. We delve into the current surge in youth entrepreneurship, underscore the pervasive financial literacy gap, highlight the critical hurdles related to early-stage funding, and propose holistic solutions encompassing education, mentorship, and access to capital to nurture this vital economic engine.

Our findings reveal a landscape characterized by unprecedented enthusiasm among young individuals to forge their own paths, fueled by both a desire for autonomy and innovation, and in many regions, the stark reality of high youth unemployment. However, this ambition is frequently met with a significant deficit in foundational financial knowledge and systemic barriers to accessing crucial startup capital. These twin challenges often predicate the early stagnation or failure of promising youth-led enterprises. This section distills the most impactful data points and insights, presenting a clear picture of the current state, the underlying problems, and the strategic interventions required to effectively transition youth-led ventures from compelling concepts to sustainable, cash-flow-positive entities capable of driving economic growth and job creation.

Youth Entrepreneurial Drive: A Global Phenomenon Fueled by Ambition and Necessity

The contemporary youth demographic, specifically Generation Z (16–24-year-olds), demonstrates an extraordinary inclination towards entrepreneurship, marking a significant departure from previous generations. Research indicates that nearly three-quarters, or 73%, of Gen Z express a desire to start their own businesses[9]. This figure reflects a dramatic surge in entrepreneurial aspiration, manifesting as a global boom in youth-led ventures. This trend is not monolithic; its drivers are multifaceted, stemming from both intrinsic ambition and extrinsic necessity.

Drivers of Youth Entrepreneurship

- Ambition and Innovation: In developed economies, young entrepreneurs are often motivated by the pursuit of financial independence, the desire for flexible working arrangements, and the technological opportunities that lower traditional barriers to entry. They leverage digital platforms, social media, and e-commerce to launch ventures with minimal upfront costs, such as mobile applications, online stores, or content creation channels[9]. This digital fluency enables them to translate innovative ideas into commercial realities, often from their own homes.

- Necessity in High Unemployment Regions: Conversely, in many emerging economies, entrepreneurship emerges as a critical pathway to economic engagement rather than merely a choice. Global youth unemployment, while having reached a 15-year low at 13% in 2023[3], still significantly exceeds adult unemployment rates. In certain countries, this disparity is even more pronounced; for example, South Africa reported a staggering 44.3% youth unemployment rate for individuals aged 15–34 in 2023[2]. Such high rates compel many young people to become “forced entrepreneurs,” creating their own income streams out of a need for survival. These necessity-driven ventures, though often starting with minimal resources, are vital for local livelihoods and contribute to job creation within their communities.

- Technological Empowering Lower Barriers to Entry: The digital age has significantly reduced the capital and infrastructural prerequisites for starting a business. Young individuals, being digital natives, are adept at utilizing online tools and platforms. This technological accessibility fosters an environment where an innovative idea can be launched globally with comparatively little overhead, contributing to the upward trend of youth entrepreneurship even amidst economic uncertainty.

Challenges Amidst Optimism

Despite this significant momentum, young founders encounter substantial hurdles that temper the optimistic outlook. A primary concern is the prevalent lack of experience and a corresponding fear of failure. Approximately 75% of Gen Z individuals aspiring to entrepreneurship voice concerns that their inexperience could jeopardize their ventures[1]. Many also admit to lacking the fundamental knowledge required to navigate regulatory landscapes, construct viable business plans, or effectively manage cash flow[1]. Furthermore, limited professional networks and a perceived lack of credibility can make it challenging for young CEOs to attract customers or investors. This implies that while the youth startup boom is robust, it is accompanied by a significant learning curve that necessitates robust support systems to ensure its sustainability beyond the initial spark of an idea.

The Critical Financial Literacy Gap: A Barrier to Scaling

A central finding of this research is the vast and pervasive financial literacy gap among youth, which poses a significant impediment to the sustained growth and scaling of their entrepreneurial ventures. While youth entrepreneurial ambition is surging, the foundational financial knowledge required to translate that ambition into a stable business is often lacking.

Prevalence of Financial Illiteracy Among Youth

Global statistics paint a stark picture: only about one-third (33%) of adults worldwide are considered financially literate[5]. Worryingly, this rate plummets dramatically among young adults. Expert research by Professor Annamaria Lusardi indicates that a mere 7% of individuals aged 18–25 globally possess “sufficient” financial literacy[10]. This exceedingly low proficiency rate means that the vast majority of young entrepreneurs embark on their business journeys with minimal understanding of core financial principles, often relying on trial-and-error, which can be a costly educational approach for a nascent business.

The downstream effects of this literacy gap are profound. A 2025 survey revealed that over two-thirds (67%) of Gen Z aspiring entrepreneurs expressly state they lack adequate financial knowledge to effectively run a business[1]. This self-identified deficit underscores a critical vulnerability, as these young individuals are precisely the demographic actively engaging in or considering launching startups.

Consequences of Poor Financial Management

The lack of financial acumen directly correlates with business failure rates. Data consistently shows that poor financial management is a primary driver of startup demise:

- Cash Flow Problems: An estimated 82% of small businesses fail due to cash flow problems[7]. This statistic highlights that businesses often collapse not because they are unprofitable in principle, but because they are unable to manage their liquidity effectively.

- Running Out of Capital: A study analyzing over 110 startup post-mortems identified “running out of cash/failing to raise new capital” as the leading cause of startup failure, cited by 38% of companies. This reason surpassed even “no market need” (35%)[6], emphasizing that even a viable idea cannot survive without proper financial stewardship.

Common financial missteps among young entrepreneurs include overestimating early revenues, underestimating operational expenses, failing to differentiate between personal and business finances, and neglecting robust record-keeping. The lack of basic budgeting skills means initial profits might be mismanaged rather than reinvested strategically for growth, leading to volatile “feast-and-famine” cycles.

Investor Confidence and Financial Savvy

Financial literacy is not just about survival; it’s also a significant factor in attracting funding. Investors and lenders exhibit a clear preference for founders who demonstrate financial competence. A 2023 study found that businesses with strong financial literacy practices were 22% more likely to secure funding from banks or investors[2]. This is because founders capable of presenting solid financial plans, credible projections, and a clear understanding of their unit economics instill confidence in potential backers. Conversely, “weak financials” or sloppy business plans are frequently cited as red flags that deter investment, regardless of the innovation inherent in the business concept. Financial literacy, therefore, translates directly into fundraising readiness and a stronger position for securing the capital needed for scaling.

The Critical Hurdle of Early Investment and the Youth Funding Gap

For any startup, the journey from concept to cash flow is heavily dependent on a judicious injection of capital at the right time. For youth-led ventures, securing this early investment represents a particularly significant and frequently insurmountable hurdle, often exacerbated by the financial literacy gap.

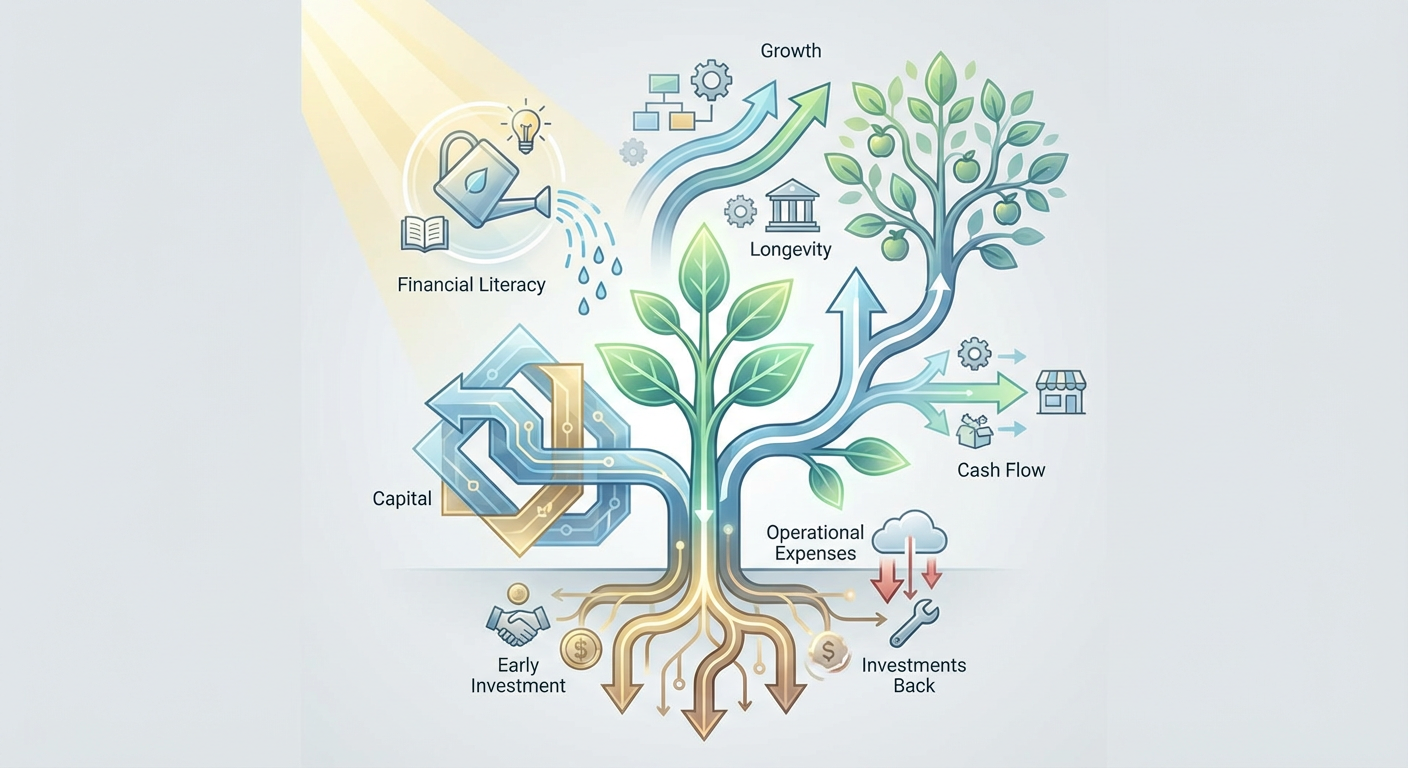

The Significance of Early-Stage Capital

Early investment is the lifeblood that allows a fledgling idea to transform into a functional business. It funds crucial activities such as product development, team hiring, market validation, and initial marketing campaigns, sustaining operations until sufficient revenue is generated. Research indicates that access to finance in the early startup stages “results in better entrepreneurial outcomes” for young founders, leading to improved survival rates and faster growth[4]. This initial capital provides a critical “runway,” allowing entrepreneurs the time to iterate their business model and achieve product-market fit without succumbing to immediate cash pressures.

The Persistent Funding Gap for Young Entrepreneurs

Despite the evident need, young founders face systemic challenges in accessing capital compared to their older counterparts:

- Traditional Lender Hesitancy: Banks and conventional financial institutions are often reluctant to provide loans to young entrepreneurs due to limited credit history, insufficient collateral, and perceived inexperience. In Europe, only about 33% of young entrepreneurs successfully obtained bank financing, a rate roughly half that of older business owners[4]. This “credit gap” means that many viable youth ventures are severely undercapitalized, struggling to scale or even survive.

- Investor Risk Perception: Venture Capital firms may also view very young CEOs as higher risk, particularly in the absence of robust business plans and demonstrated financial acumen. This makes the initial capital raise particularly challenging for those who are simultaneously learning the ropes of financial management.

- Self-Identified Barrier: The lack of capital is not merely an external observation but a keenly felt reality for young entrepreneurs themselves. Nearly one-third (31%) of Gen Z entrepreneurs cite insufficient financial resources as their biggest deterrent to starting or growing their business[1]. This makes it the most commonly self-reported barrier, even over market competition.

The Necessity of Bootstrapping and Its Limitations

Faced with these barriers, many young entrepreneurs are forced to bootstrap their ventures using personal funds. Approximately 19% of Gen Z entrepreneurs have resorted to personal savings or taking on personal debt to sustain their businesses[1]. While bootstrapping can foster financial discipline, lean operations, and a strong sense of ownership, it also presents significant drawbacks:

- Limited Growth Potential: Relying solely on personal funds severely restricts a venture’s capacity for rapid growth, as capital availability dictates the pace of expansion, marketing, and talent acquisition.

- Increased Personal Risk: Blurring the lines between personal and business finances, a common outcome of bootstrapping, exposes founders to greater personal financial risk if the business struggles. Mismanagement or unforeseen setbacks can have devastating consequences for both the business and the entrepreneur’s personal financial well-being.

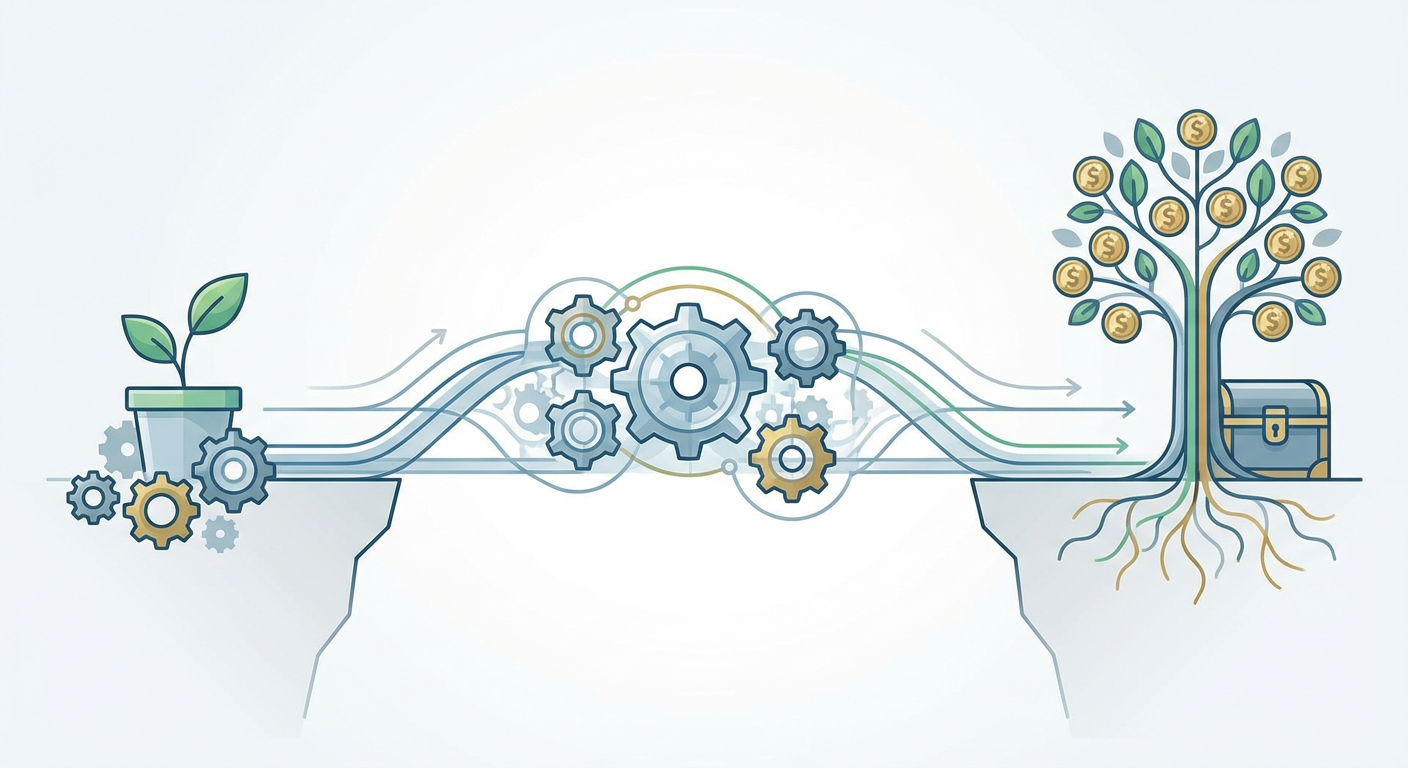

Emerging Solutions and Investor Readiness

To address this critical funding gap, an evolving ecosystem of alternative financing and support mechanisms is emerging. Youth-focused incubators, startup competitions providing seed funding, and crowdfunding platforms specifically target young innovators. These platforms often combine modest investment with invaluable mentorship. For example, Youth Business International (YBI) supported 18,014 young people in starting new businesses in 2021, and strengthened over 38,000 existing youth-led businesses through training and mentoring programs[11]. These initiatives collectively demonstrate that targeted programs can effectively bridge the funding chasm, enabling thousands of young entrepreneurs to move from mere ideas to operational businesses.

Furthermore, building “investor readiness” is paramount. Young entrepreneurs who invest time in comprehensive market research, developing a Minimum Viable Product (MVP), and preparing robust financial projections significantly increase their attractiveness to investors. Financial pitch training and business plan competitions are vital in helping young founders translate their raw ideas into structured business cases capable of securing that crucial first capital injection. When successful, this early influx of funds, often coupled with mentorship, can dramatically accelerate a venture’s trajectory.

Bridging the Skills Gap: Education, Mentorship, and Ecosystem Support

The challenges faced by youth-led ventures, particularly those related to financial literacy and access to capital, highlight the urgent need for comprehensive interventions. Education, targeted training, and robust mentorship pipelines are proving to be the most effective strategies for empowering young entrepreneurs to navigate complex business landscapes and achieve sustainable growth.

Embedding Financial Literacy in Educational Systems

A fundamental solution involves integrating personal and business financial education into formal academic curricula at earlier stages. Calls for schools and universities to include modules on budgeting, investing, and the foundational aspects of entrepreneurship are gaining traction. The rationale is clear: equipping young individuals with financial literacy before they enter the workforce or launch a business significantly enhances their preparedness. Alumni of youth entrepreneurship programs, such as Junior Achievement or BizWorld (which notably impacted Bella Lin of GuineaLoft[12]), often exhibit superior budgeting and business planning skills, which directly translate into more successful ventures later in life.

Impactful Training and Startup Programs

Numerous global initiatives are designed to provide young entrepreneurs with the necessary skills and resources. The Youth Business International (YBI) network, for instance, supported over 10,000 young entrepreneurs across seven countries through integrated programs offering training, mentoring, and financial services[11]. In 2021 alone, YBI’s efforts led to the creation of over 18,000 new youth-led businesses and the strengthening of approximately 38,000 existing ones[11]. Similar bootcamps and workshops focused on cash-flow management, marketing, and loan readiness are offered by financial institutions and fintech companies. These programs are instrumental in demystifying business finance and building confidence and competence among young founders.

The Indispensable Role of Mentorship

Mentorship is consistently cited as a transformative factor for young entrepreneurs. A staggering 68% of youth entrepreneurs express a strong desire for guidance from experienced business or finance experts[1]. Mentors, who can range from seasoned executives to local business owners, offer invaluable practical advice on complex challenges such as pricing strategies, negotiation tactics, and operational efficiencies that theory alone cannot provide. Beyond practical guidance, mentors offer networking opportunities and crucial emotional support through the often tumultuous journey of startup life. For young founders lacking established professional networks, mentorship provides a vital bridge to the broader business community.

Targeting Underrepresented Youth for Inclusive Growth

Recognizing that certain youth demographics face even greater barriers, initiatives are increasingly tailoring support programs for underrepresented groups, including young women, minorities, and individuals from low-income backgrounds. These programs often combine financial literacy training with confidence-building and pitching skills to address inherent biases. Microfinance initiatives in emerging markets, exemplified by the Tony Elumelu Foundation’s support for Eliab Mayengo of Orca-Pod Holdings[15], provide small loans alongside coaching, demonstrating that inclusive support amplifies economic impact by fostering job creation and innovation in underserved markets. The core principle is that talent is universal, but opportunity is not, and targeted interventions can effectively close this gap.

Cultivating an Enabling Entrepreneurial Ecosystem

Ultimately, the successful scaling of youth-led ventures requires a multi-stakeholder ecosystem approach. Policymakers can contribute by simplifying business registration processes, offering startup grants, and providing tax incentives. Educational institutions can partner with industry to establish innovation labs and seed funds. Even large corporations are engaging through mentorship programs. The most effective ecosystems integrate knowledge acquisition (business and financial skills), practical experience (internships, mini-company projects), and access to vital resources (funding, networks). As these interconnected elements mature, the pathway from a young person’s entrepreneurial idea to a thriving, cash-flow-generating enterprise becomes significantly smoother, yielding benefits for both individual entrepreneurs and the broader economy.

Mastering Cash Flow: The Linchpin for Young Ventures’ Stability and Scale

For any startup, but particularly for nascent youth-led ventures, the ability to effectively manage cash flow is not merely a best practice; it is the fundamental determinant of survival and the primary prerequisite for scaling. The adage “cash flow is king” resonates profoundly within the context of young businesses, which often begin undercapitalized and operate with lean margins.

The Primacy of Cash Flow for Startups

Achieving and maintaining positive cash flow—where money entering the business consistently exceeds money leaving it—is the ultimate goal for moving from a concept to a sustainable operation. Many young founders, driven by innovative ideas, tend to prioritize product development or sales growth, often overlooking the intricate dance of cash inflows and outflows. However, even a growing business can quickly face insolvency if its cash reserves are depleted due to mismatches in payment timing. For example, a promising e-commerce venture might generate significant sales but stumble if it must pay suppliers for inventory before receiving payments from customers. Equipping young entrepreneurs with the skills to forecast cash flow, monitor their “burn rate” (monthly operating expenses), and maintain adequate cash reserves is crucial for preventing such common pitfalls and ensuring long-term viability.

Common Cash Management Pitfalls for Youth-Led Businesses

Youth-led startups frequently fall prey to several identifiable cash management errors due to inexperience or a lack of formal financial training:

- Overestimation of Revenue and Underestimation of Expenses: New entrepreneurs often project optimistic revenue figures and overlook various indirect or unexpected costs, leading to cash shortages when sales ramp up slower than anticipated or unforeseen expenses arise.

- Commingling Personal and Business Funds: A widespread issue, particularly among bootstrapped ventures, is the failure to maintain a strict separation between personal and business finances. This can lead to business funds being siphoned off for personal needs, or personal savings being improperly used to prop up a struggling business, creating instability and blurring financial accountability. A survey by the SA Institute of Business Accountants noted significant struggles among young South African entrepreneurs with keeping personal spending separate from business funds[2].

- Inadequate Record-Keeping: Without meticulous tracking of income and expenses, young founders may lose visibility into their financial health, overlooking overdue invoices, impending tax obligations, or large annual expenses until it’s too late.

These issues underscore the absolute necessity of financial discipline from the outset. As one study notes, “82% of business failures are attributable to poor cash-flow management”[7], an alarming statistic that underscores how critical this skillset is.

Practical Strategies for Healthy Cash Flow

To mitigate these risks and foster resilient growth, several practical strategies are recommended for first-time entrepreneurs:

- Establish a Cash Buffer: Maintaining a reserve of cash is vital to absorb unexpected costs, cover payment delays from clients, or withstand temporary downturns.

- Prompt Invoicing and Payment Terms Enforcement: Young founders must be proactive in invoicing clients promptly and diligently following up on outstanding payments. Delays in accounts receivable are a leading cause of cash flow squeezes.

- Strategic Expense Management: Where possible, negotiate payment terms with suppliers, stagger large expenditures, or explore credit options that align with incoming revenue cycles.

- Regular Financial Monitoring: Consistent tracking of key financial metrics—including cash balance, accounts receivable, accounts payable, and gross margins—is non-negotiable. Modern accounting software and budgeting applications can simplify this process, making sophisticated financial tracking accessible even to novice entrepreneurs.

By proactively utilizing such tools and adhering to these disciplines, young founders can implement robust financial controls, keeping their cash flow under constant surveillance and management.

Budgeting, Reinvestment, and Agile Pivoting

Budgeting, while seemingly basic, forces entrepreneurs to meticulously plan resource allocation, revealing the financial sustainability of their business model. Youth ventures that effectively budget tend to make more prudent spending decisions, resisting the temptation for non-essential expenditures until their financial position allows. The habit of systematically reinvesting initial profits back into the business—for example, allocating a percentage of sales to marketing or inventory—is crucial for sustained, cash-flow-positive growth. Conversely, undisciplined spending can lead to unstable cycles that hinder long-term success.

Moreover, the inherent agility of young entrepreneurs can be a powerful asset when combined with cash flow awareness. Savvy founders closely monitor their “cash runway”—the duration for which their current funds can sustain operations—using it as a vital trigger to implement strategic pivots or cost reductions. If, for instance, an app’s user growth is too slow to cover expenses, understanding the cash runway can prompt a timely pivot to a new market segment or a revised pricing model before funds are completely exhausted. This discipline to adapt quickly in response to financial realities is often what differentiates businesses that scale from those that fail prematurely. By mastering cash flow, young entrepreneurs transform their ventures from mere ideas into financially robust entities ready for expansion.

Notable Case Studies: Illustrating the Impact of Financial Literacy and Early Investment

Concrete examples illustrate how the interplay of financial literacy, early investment, and strategic decision-making can propel youth-led ventures from nascent concepts to significant enterprises.

Stripe (USA/Ireland): From Teenage Developers to Fintech Giant

Founded by brothers John and Patrick Collison, aged 19 and 21 respectively, Stripe is a prime example of early financial acumen combined with strategic investment. Their prior experience selling their first startup, Auctomatic, for $5 million in 2008 (while John was still in high school) provided initial capital and demonstrated early entrepreneurial prowess[14]. Participation in Y Combinator’s accelerator program further provided crucial seed capital and mentorship. Stripe’s online payments platform flourished due to their meticulous attention to unit economics and impressive financial competence, even at a young age. This capability attracted major investors early on, such as Sequoia Capital and Andreessen Horowitz, fueling explosive growth. By 2022, Stripe reached a valuation of $95 billion, becoming a global fintech leader[14]. The Collisons’ story highlights how financial savviness and access to early, strategic funding can scale an innovative idea globally.

OYO Rooms (India): Teenage Vision to Hospitality Unicorn

Ritesh Agarwal’s journey with OYO Rooms showcases the transformative power of early investment and dedicated learning. Dropping out of college at 17, Agarwal started OYO as a budget hotel marketplace. In 2013, a $100,000 Thiel Fellowship grant provided not just capital but invaluable exposure to Silicon Valley mentors, where he honed his financial literacy and pitching skills[13]. By 2015, at 21, Agarwal secured a $100 million Series B round, impressing investors with his data-driven approach to standardizing affordable hotels[13]. Further rounds, including a $1 billion raise in 2018 (valuing OYO at $5 billion), allowed rapid scaling across India and internationally[13]. OYO’s trajectory demonstrates how a young founder, equipped with early backing and mentorship, can swiftly convert a localized idea into a multi-billion-dollar enterprise by mastering capital deployment and strategic growth.

GuineaLoft (USA): Teenage Entrepreneur’s Six-Figure Success

Bella Lin, a 17-year-old, illustrates the impact of disciplined financial management starting with minimal capital. In 2022, using just $2,000 of her savings, she launched GuineaLoft, focused on improved guinea pig cages, on Amazon[12]. She leveraged skills gained from a youth entrepreneurship program, meticulously reinvesting profits into inventory and marketing. This financial discipline yielded remarkable results: in 2023, GuineaLoft sold approximately 11,000 units, generating $409,000 in revenue[12]. By 2024, monthly sales doubled to $71,000[12]. Bella’s story underscores that even without large external investments, a teen entrepreneur with a strong grasp of budgeting, careful management of unit costs, and strategic use of online platforms can build a thriving, cash-flow-positive venture.

Orca-Pod Holdings (Uganda): Scaling an Industrial Vision with Seed Capital

Eliab Mayengo, the founder of Orca-Pod Holdings, an industrial brick-making venture in Uganda, demonstrates the powerful multiplier effect of modest seed capital paired with financial training in an emerging market context. Having started making bricks at age 12 to pay school fees, Mayengo struggled with finance for years. In 2018, his selection for the Tony Elumelu Foundation entrepreneurship program provided a critical turning point: a seed grant, coupled with essential financial training and mentorship. This intervention led to dramatic growth: Orca-Pod’s workforce expanded from 20 to 45 employees, and annual revenue surged from UGX 145 million to UGX 201 million (a 39% increase) within a year[15]. Mayengo utilized the funds to build an eco-friendly kiln and expand production. His case epitomizes how targeted early investment and financial literacy support can transform a micro-operation into a scalable enterprise addressing critical community needs, proving the profound impact of providing “Money, Mentorship, and Markets” to promising young entrepreneurs.

Conclusion: A Path Forward

The landscape of youth entrepreneurship is vibrant and brimming with potential, yet it is critically constrained by widespread financial illiteracy and significant barriers to early-stage capital. The data unequivocally demonstrates that while Gen Z’s entrepreneurial ambition is at an all-time high, the fundamental skills and resources necessary to convert these aspirations into sustainable, scalable businesses are often lacking. The devastating impact of cash flow problems and inadequate funding on startup survival underscores that financial discipline and access to capital are not secondary concerns but existential requirements.

However, the research also illuminates a clear path forward. Strategic interventions focused on enhancing financial literacy, providing targeted entrepreneurship education, fostering robust mentorship networks, and creating more accessible early-stage funding mechanisms can dramatically improve outcomes for youth-led ventures. By investing in these foundational elements, we can transform a generation of ambitious, digitally-native individuals into a powerful force of job creators and economic innovators. The success stories, from billion-dollar fintech to local manufacturing, serve as compelling evidence that with the right support system, youth-led concepts can indeed transition effectively from innovative ideas to flourishing, cash-flow-positive enterprises.

The subsequent sections of this report will delve deeper into each of these critical areas, providing a detailed analysis of the financial literacy gap, the dynamics of early investment, and proposed frameworks for comprehensive support ecosystems.

2. The Rise of Youth Entrepreneurship: Ambition Meets Necessity

The global landscape is witnessing a profound shift in entrepreneurial demographics, with young people increasingly emerging as the driving force behind new ventures. This surge in youth-led businesses is not merely a fleeting trend but rather a robust phenomenon fueled by a complex interplay of personal ambition, technological advancements, and pressing economic necessities. For a generation often portrayed as digital natives, the barriers to entry in establishing a business have diminished significantly, empowering individuals to transform ideas into viable enterprises with unprecedented ease. However, while the excitement surrounding youth entrepreneurship is palpable, this burgeoning movement is not without its inherent challenges, particularly in securing crucial early-stage investment and navigating the often-complex world of financial management. This section delves into the multifaceted factors contributing to this global surge, examining both the opportunities technology presents and the common pitfalls young founders encounter as they strive to translate their concepts into sustainable cash flow.

The Evolution of Youth Entrepreneurial Drive: A Global Phenomenon

A significant generational paradigm shift is currently unfolding, characterized by a burgeoning entrepreneurial spirit among younger demographics. This is particularly evident within Generation Z (individuals aged 16–24), where nearly three-quarters, specifically 73%, express a strong desire to initiate their own businesses, according to a 2025 survey15. This ambition rate stands notably higher than that observed among older generations, signaling a pronounced and widespread global boom in youth-led ventures. This phenomenon is not monolithic; it is underpinned by diverse motivations that range from the pursuit of independent career paths and the desire for financial autonomy to a proactive response to challenging economic environments15. The drivers of this youth entrepreneurial boom can be broadly categorized into two primary forces: opportunity and necessity. In developed nations, many Gen Z individuals perceive entrepreneurship as a conduit for innovation, a platform to realize passion projects, and a means to achieve flexible working arrangements that traditional employment structures often cannot provide15. These “opportunity entrepreneurs” are leveraging technological fluency and access to digital tools to craft businesses that align with their personal values and aspirations. They are often driven by a desire to innovate, challenge existing paradigms, and build enterprises that reflect a more modern, flexible, and purpose-driven approach to work. The appeal of being one’s own boss, setting one’s own hours, and directly seeing the impact of one’s efforts resonates deeply with a generation that values autonomy and creativity. Conversely, in many emerging economies, entrepreneurship often arises from necessity. Persistent high youth unemployment rates globally serve as a powerful impetus for young people to create their own income streams, transforming job-seekers into job creators12. The International Labour Organization (ILO) reported that global youth unemployment stood at 13% in 202310. While this represents a 15-year low, it remains significantly higher than the overall adult unemployment rate, underscoring the severe challenges young people face in securing traditional employment. In certain regions, this figure escalates to critical levels. For instance, in South Africa, the youth jobless rate (for ages 15–34) reached a staggering 44.3% in 202311. Such extreme conditions compel a substantial segment of the youth population to become “forced entrepreneurs,” establishing small businesses primarily to ensure their livelihoods and contribute to their families’ economic well-being11. These necessity-driven ventures, though often initiated with minimal capital and resources, play a crucial role in local economies and highlight the sheer resilience and adaptability of young individuals confronting adverse circumstances. In such contexts, financial literacy and access to startup capital are not merely advantages but rather indispensable lifelines, enabling young founders to build businesses that sustain themselves and potentially create employment opportunities for others in their communities. The proliferation of technology has played an instrumental role in lowering the barriers to entry for aspiring young entrepreneurs. Digital natives, growing up immersed in the internet and social media, are adept at harnessing online platforms, e-commerce marketplaces (such as Amazon, Etsy), and social media channels (like Instagram, TikTok) to launch and grow businesses with considerably less upfront investment than was traditionally required. The capability to set up an online store, develop a mobile application, or build a robust social media presence from a bedroom has democratized entrepreneurship. This technological enablement reduces the need for physical storefronts, large inventories, or extensive capital for marketing campaigns, thereby making entrepreneurial endeavors more accessible to individuals with limited financial resources. This reduction in overhead and operational complexities partly explains why youth entrepreneurship continues its upward trajectory, even amidst periods of economic uncertainty and instability. The ability to reach a global customer base from virtually anywhere has fundamentally reshaped the entrepreneurial landscape, fostering a more inclusive and dynamic environment for young innovators.

Common Challenges Faced by Young Founders

Despite the palpable enthusiasm and the undeniable advantages offered by technology, the path of youth entrepreneurship is fraught with significant challenges. These hurdles can temper even the most optimistic outlooks and often contribute to the high failure rates observed among new ventures. One of the most frequently cited concerns among young aspiring entrepreneurs is a perceived lack of experience and a corresponding fear of failure. A survey revealed that 75% of Gen Z individuals hoping to start businesses are anxious that their inexperience could ultimately lead to their venture’s downfall13. This sentiment is not unfounded, as many young founders confess to lacking fundamental knowledge concerning business operations, such as navigating complex regulatory frameworks, drafting comprehensive business plans, or proficiently managing cash flow during the nascent stages of their enterprises13. The formal educational system often does not adequately prepare students for the practical realities of launching and scaling a business, leaving many to learn through trial and error—a costly and often perilous method in the competitive startup world. Furthermore, young founders often contend with limited professional networks and a lack of established credibility. For a 20-year-old CEO, securing initial customers, attracting pivotal investment, or forging strategic partnerships can be significantly more challenging compared to an older, more experienced entrepreneur with a track record and an extensive professional network. Traditional lenders and investors may view younger entrepreneurs as higher risk due to their limited business history, leading to difficulties in accessing capital. This is compounded by the fact that young individuals may not have had the opportunity to build the social capital and industry connections that are often crucial for business success. These factors highlight that while the initial spark of youth entrepreneurship is vital, sustained growth necessitates robust support systems that extend beyond initial enthusiasm. The “youth startup boom,” therefore, brings with it a substantial learning curve, underscoring the critical need for targeted education, mentorship, and financial interventions to help these ventures not only launch but also thrive and scale.

The Critical Role of Financial Literacy in Startup Success

While passion and innovative ideas are foundational, the financial acumen of a founder often proves to be the ultimate differentiator between a transient project and a sustainable, growing business. Mastering the fundamentals of finance—encompassing budgeting, accurate bookkeeping, strategic pricing, and prudent credit management—is emerging as a paramount success factor for youth-led ventures. Startups spearheaded by financially literate founders demonstrably possess a clear competitive advantage. A study conducted in Africa, for instance, revealed that businesses led by entrepreneurs with strong financial literacy practices were 22% more likely to successfully secure funding from banks or other investors12. This heightened probability of attracting capital is largely due to the ability of financially savvy founders to present robust business cases, backed by detailed financial projections and a clear understanding of their venture’s economic health. Such competence enables them to allocate resources more efficiently, avoid the pitfalls of crippling debt, and strategically price their products or services for optimal profitability. Despite its critical importance, a widespread deficiency in financial literacy persists among young entrepreneurs. This knowledge gap places many at a significant disadvantage from the outset. Global research indicates alarming statistics regarding financial proficiency among young adults: merely 7% of individuals aged 18–25 are classified as possessing “sufficient” financial literacy8,10. This exceedingly low proficiency rate suggests that the vast majority of young founders commence their entrepreneurial journeys with minimal understanding of core financial principles. Many educational systems fail to adequately incorporate practical financial education, meaning young individuals often reach adulthood without fundamental knowledge regarding interest rates, effective cash flow management strategies, or the complexities of business taxation. This deficit frequently leads to foundational errors, such as underestimating operational costs, conflating revenue with actual profit, or overlooking critical financial deadlines, such as tax filings or loan repayments. Such errors, though seemingly minor, can rapidly escalate into existential threats for a nascent business. The repercussions of poor financial management are starkly evident in the high failure rates attributable to monetary mismanagement. Indeed, running out of cash or failing to secure new capital ranks as the foremost reason for startup failure, accounting for 38% of cases according to an analysis of over 110 startup post-mortems5. This figure even surpasses “no market need” (35%) as a leading cause of demise, underscoring that even a viable business idea can falter without adequate financial scaffolding. Broader analyses of small business failures provide an even more sobering statistic: an estimated 82% of small businesses ultimately fail due to issues stemming from poor cash flow management6. Common scenarios that precipitate such failures include excessive spending on non-essential items, neglecting to maintain adequate emergency reserves, inaccurate product pricing, or a failure to collect accounts receivable in a timely manner. These issues underscore that “cash flow is king” and that young entrepreneurs who lack fundamental budgeting and cash management skills may belatedly discover that their otherwise brilliant concept is unsustainable without a robust financial foundation. Furthermore, financial literacy significantly bolsters a young founder’s credibility with investors and strategic partners. An entrepreneur capable of articulating detailed financial projections, conducting thorough break-even analyses, and demonstrating a clear understanding of unit economics commands respect, irrespective of their age. Lenders and venture capitalists frequently identify “weak financials” or poorly constructed business plans as significant red flags when evaluating youth-led startups. Conversely, founders who present data-driven financial plans and exhibit a nuanced comprehension of financial risks are considerably more likely to gain the trust—and critically, the capital—they require. Essentially, financial literacy transforms a promising concept into a fundable business by unequivocally demonstrating its viability and the founder’s competence. A foundational lesson for all nascent entrepreneurs, yet one frequently overlooked by young individuals, is the imperative to maintain strict separation between personal and business finances. Many young founders, often out of convenience or a lack of formal training, commingle their personal funds with their business accounts. Financial literacy inoculates against this by instilling the discipline required to establish proper bookkeeping practices and separate banking accounts. This delineation is crucial not only for accurate tax reporting but also for genuinely assessing the business’s performance. Financial experts advocate for founders to pay themselves a predetermined salary rather than irregularly drawing from business coffers6. Young business owners who internalize this principle maintain transparent records and foster greater accountability. In essence, financially literate founders treat their startup as a distinct, independent entity from its inception, rather than as a mere extension of their personal wallet.

Early Investment: Fueling Growth at the Critical Stage

For any startup to successfully transition from an abstract concept to a fully operational, sustainable enterprise, early investment often serves as the indispensable catalyst. The initial influx of capital, whether sourced from personal savings, friends, and family, angel investors, or specialized seed funds, is crucial for myriad foundational activities. This includes hiring essential team members, developing prototypes, launching critical marketing campaigns, and covering operational overhead during the pre-revenue or early revenue phases. Research emphatically demonstrates that when young entrepreneurs secure funding during these seed stages, their ventures achieve markedly superior outcomes, exhibiting higher rates of survival and accelerated growth9. This early capital provides a vital “runway” that allows founders the necessary time and resources to iterate on their business model, gather market feedback, and ultimately achieve product-market fit, thereby mitigating the risk of premature failure due to immediate cash flow pressures. Despite the unequivocal importance of early investment, young founders frequently encounter significant obstacles in raising capital compared to their older, more experienced counterparts. Traditional banking institutions often exhibit reluctance to extend loans to young entrepreneurs who typically possess limited credit histories or lack substantial collateral. Similarly, venture capital firms may perceive very young CEOs as inherently higher risk due to their perceived inexperience in navigating complex business landscapes. Data from the European market, for example, illustrates this disparity starkly: youth entrepreneurs are approximately half as likely to secure a bank loan or a line of credit compared to older business owners9. Specifically, only about 33% of young entrepreneurs in Europe managed to obtain bank financing for their ventures9. This substantial “financing gap” often results in under-capitalized youth ventures that are compelled to operate on shoestring budgets, which can severely stunt their growth potential or force founders to abandon their promising ventures once personal funds are exhausted. Given these formidable external funding barriers, it is unsurprising that a significant proportion of young entrepreneurs must resort to self-financing (bootstrapping) during their startup’s initial phase. A Canadian survey found that 19% of Gen Z entrepreneurs had withdrawn from personal savings or incurred personal debt to sustain their businesses4. While bootstrapping can cultivate a culture of creativity, resourcefulness, and lean operations—as evidenced by success stories like Spanx or Mailchimp, which scaled without external venture capital—it inherently entails slower growth trajectories and exposes founders to greater personal financial risk. Young founders with limited personal savings capacities can quickly reach a critical juncture where they lack the capital to scale production, invest in vital marketing initiatives, or even afford themselves a living wage, thereby making external capital indispensable for meaningful expansion. The funding landscape, however, is continuously evolving, with an increasing array of alternative financing options emerging to specifically target young innovators. Mentorship-driven accelerators, competitive startup competitions, and democratized crowdfunding platforms have surfaced as crucial mechanisms to bridge this funding gap. Accelerators, for instance, often furnish a modest seed investment (e.g., $25,000) coupled with intensive mentorship in exchange for an equity stake. This model proved pivotal for the Collison brothers, then 19 and 21, in launching Stripe and subsequently attracting larger investors20. Crowdfunding, conversely, empowers young creators to pre-sell products or services to a broader audience, thereby funding development and production. Additionally, various governmental grants and philanthropic foundation programs, such as the Tony Elumelu Foundation in Africa, specifically award seed capital to youth-led startups. While each of these options presents its own set of advantages and disadvantages, collectively they represent an expanding ecosystem of innovative early financing solutions designed to nurture concepts through their nascent stages when traditional banks or venture capitalists might be reluctant to commit. This ecosystem is vital for fostering a new generation of entrepreneurs who might otherwise be excluded from the traditional financial system. A fundamental aspect of overcoming funding challenges is building “investor readiness.” The difficulty young startups face in securing funding is not solely attributable to a lack of investor appetite; often, the ventures themselves are not adequately prepared for external investment. Early investment is considerably more attainable when founders undertake diligent preparatory work, including conducting thorough market research, developing a minimum viable product (MVP), and, crucially, preparing robust financial projections. Young entrepreneurs who dedicate concerted effort to these preliminary steps are able to approach funders with more than just enthusiasm; they can present compelling business cases underpinned by realistic unit economics and a clear, data-driven pathway to profitability. Initiatives focused on financial pitch training and business plan competitions are instrumental in bridging this gap, helping to transform raw ideas into structured, financially sound proposals capable of attracting that pivotal initial capital injection. When successful, this infusion of funds (often accompanied by invaluable mentorship) can dramatically accelerate a venture’s trajectory, propelling it toward its scaling goals.

Bridging the Skills Gap: Education and Mentorship for Young Founders

Addressing the fundamental challenges faced by emerging young entrepreneurs necessitates a focus on comprehensive education and robust mentorship programs. To tackle the root cause of financial illiteracy, many experts advocate for the earlier and broader integration of financial education into formal curricula. There is a growing movement to embed personal finance and basic business finance principles within high school and college coursework. This proactive approach aims to equip students with essential knowledge concerning budgeting, principles of investing, and the foundational elements of entrepreneurship before they even contemplate launching a business. The rationale is clear: if young people graduate possessing a solid grasp of financial literacy, they will be significantly better equipped to manage their personal finances, let alone successfully operate a business. Real-world evidence already supports this, with alumni of youth entrepreneurship programs, such as Junior Achievement or BizWorld, often exhibiting enhanced budgeting and business planning proficiencies, which translate into more successful startup ventures in their twenties. Globally, numerous initiatives are demonstrating remarkable success in empowering young individuals with the requisite skills and resources to thrive in the business world. The Youth Business International (YBI) network, for instance, in a recent program, supported over 10,000 young entrepreneurs across seven countries through a combination of training, comprehensive mentoring, and access to financial services11. Similarly, prominent financial institutions like TD Bank and innovative fintech companies are actively hosting bootcamps and workshops tailored for young entrepreneurs, focusing on practical skills such as cash flow management, effective marketing strategies, and loan readiness preparation. These programs yield tangible benefits: YBI reports that in a single year, tens of thousands of youth-led businesses were either successfully launched or significantly strengthened as a direct result of its extensive programs14. By demystifying the complexities of business finance and supplying expert coaching, such initiatives instil significant confidence and competence in young founders, enabling them to navigate the entrepreneurial journey more effectively. The role of one-on-one mentorship is consistently highlighted by successful young entrepreneurs as a pivotal game-changer. A seasoned mentor, whether a retired executive, an experienced founder, or a local business owner, can provide invaluable guidance through challenges that textbooks alone cannot adequately address, such as nuanced pricing strategies, intricate negotiation tactics, or navigating complex industry dynamics. The demand for such personalized guidance is clear: approximately 68% of young entrepreneurs express a strong desire for mentorship from successful business or finance experts3. Organizations like SCORE in the United States actively facilitate these vital matches, pairing volunteer mentors with budding business owners. The right mentor not only furnishes expert advice but also provides crucial networking connections and essential emotional support, which are invaluable during the often tumultuous trajectory of startup life. For young individuals who may lack established professional networks, mentorship serves as a vital bridge to the broader business community, offering insights and opportunities that might otherwise be inaccessible. It is also crucial to acknowledge that within the broad demographic of young people, certain groups face compounded barriers. Young women, ethnic minorities, and individuals from low-income backgrounds frequently experience even greater difficulties in accessing capital, training, and robust professional networks. Recognizing this disparity, many programs are progressively tailoring their support to be more inclusive and targeted. For example, some incubators specifically focus on fostering young female founders, integrating financial literacy training with confidence-building workshops and pitching skills to counteract inherent gender biases in entrepreneurship. Similarly, microfinance initiatives in various countries provide small loans coupled with essential coaching to rural youth or those lacking conventional collateral. Early results from these inclusive approaches indicate that when support is equitable and accessible, a more diverse cohort of young entrepreneurs can flourish. This, in turn, amplifies the broader economic impact through increased job creation and innovation within previously underserved markets. The underlying principle is profound: while talent is universally distributed, opportunity is not. Bridging this opportunity gap through targeted education and mentorship unleashes entrepreneurial potential in segments of society that have historically been marginalized. Ultimately, fostering the successful scaling of youth-led ventures necessitates a comprehensive ecosystem approach. Policymakers have a critical role to play by advocating for the integration of entrepreneurship courses into educational frameworks, simplifying burdensome business registration processes for first-time founders, and offering targeted startup grants or tax incentives specifically for youth-owned businesses. Educational institutions, including schools and universities, are increasingly forging partnerships with industry to establish innovative labs and seed funds to support student startups. Even large corporations are contributing through mentorship initiatives, such as Google’s “Startup School,” which provides free training resources. The most effective programs seamlessly integrate theoretical knowledge (encompassing financial and core business skills), practical, hands-on experience (through projects or internships), and direct access to vital resources (including funding and professional networks). As these interconnected ecosystem elements solidify, the pathway from a young person’s initial idea to a cash-flow-positive, thriving enterprise becomes considerably smoother. The return on investment is twofold: individual young people gain sustainable livelihoods and enhanced confidence, while national and global economies benefit from a dynamic new generation of innovators and job creators.

Mastering Cash Flow: The Linchpin of Young Venture Sustainability

The journey from concept to a cash-flow-positive business represents the defining challenge for virtually every new venture, a challenge often magnified for youth-led startups that typically commence operations with limited capital. The adage “cash flow is king” encapsulates a fundamental truth: a business’s survival hinges on consistently having more cash inflows than outflows each month. While many young founders, driven by enthusiasm, prioritize revenue generation and rapid growth, overlooking the intricate timing and management of cash flows can lead even a seemingly prosperous business to collapse. For instance, a small e-commerce venture, despite enjoying robust sales, can face severe financial distress if payments for inventory are due significantly before customer payments are received. Equipping young entrepreneurs with the skills to effectively create cash flow forecasts, diligently monitor their “burn rate” (monthly operating expenses), and maintain adequate cash reserves can literally determine whether their venture scales successfully or shutters prematurely. Youth-led businesses frequently fall prey to several common cash management pitfalls. One prevalent error is to optimistically overestimate early revenues while simultaneously underestimating operational expenses. This often results in a severe cash crunch when actual sales grow more slowly than anticipated or costs are higher than planned. Another critical misstep is the failure to maintain a strict separation between personal and business finances; a founder might inadvertently withdraw funds for personal needs, thereby inadvertently undercapitalizing the business, or vice-versa. A survey conducted by the SA Institute of Business Accountants highlighted that many young South African entrepreneurs grapple with preventing personal spending from encroaching upon business capital11. Furthermore, without meticulous record-keeping, young business owners may fail to track overdue client invoices or neglect to anticipate significant upcoming annual expenses such as taxes or insurance premiums. These issues vividly underscore why disciplined cash flow management is not merely beneficial but absolutely crucial from the nascent stages of any entrepreneurial endeavor. To cultivate healthy cash flow, financial advisors recommend several practical strategies tailored for first-time entrepreneurs. These include: (a) establishing and maintaining a robust cash buffer, as even a modest reserve can absorb unexpected costs or mitigate delays in payments; (b) issuing invoices promptly and rigorously enforcing payment terms, as delayed collections are a primary cause of cash flow constriction; (c) strategically staggering expenses whenever feasible, for instance, by negotiating payment plans or credit terms with suppliers that align with the business’s revenue cycle; and (d) diligently monitoring key financial metrics on a monthly basis, such as cash balance, accounts receivable, accounts payable, and gross margins. Contemporary young entrepreneurs benefit from a plethora of user-friendly applications and software tools, ranging from robust platforms like QuickBooks to free budgeting apps, which can automate and streamline the tracking of these metrics. By proactively leveraging these digital tools, even a 19-year-old founder can implement sophisticated financial controls that maintain optimal cash flow, ensuring operational stability and paving the way for sustainable growth. The ability to budget effectively, though seemingly basic, is a skill frequently lacking among new entrepreneurs. The process of creating a comprehensive budget compels founders to meticulously plan how every dollar will be allocated, inherently revealing whether their business model is financially sustainable. Youth ventures that embrace rigorous budgeting practices tend to make more judicious decisions, such as deferring impulse expenditures on non-essential items (e.g., lavish offices, premium equipment) until they are genuinely affordable and justifiable. Adhering to a budget instills critical spending discipline and ensures that initial profits are strategically reinvested into growth initiatives rather than being indiscriminately consumed. For example, a young fashion brand owner might consistently budget a specific percentage of sales to be reinvested into marketing campaigns and inventory replenishment. Founders who adopt this systematic approach can accelerate growth while maintaining a positive cash flow. In contrast, those who spend freely during periods of increased sales often find themselves caught in a cycle of “feast and famine,” characterized by intermittent financial instability and heightened stress. Therefore, cultivating fundamental budgeting skills and the habit of reinvesting profits are hallmarks of youth-led ventures that successfully achieve scale. An inherent advantage many young entrepreneurs possess is their innate agility and willingness to iterate rapidly. This flexibility allows them to quickly pivot their business model when an initial approach proves ineffective. This agility is most potent when directly informed by cash flow signals. Astute young founders meticulously track their “cash runway” – the duration until their funds are completely depleted – and utilize this metric as a critical trigger to initiate strategic pivots or implement cost-reduction measures proactively. For instance, if a mobile application exhibits sluggish user growth and its revenue fails to cover operational expenses, a timely pivot might involve targeting a new market segment or refining the pricing model *before* the business runs out of cash. Experienced mentors frequently coach young entrepreneurs on how to interpret early financial warning signs, enabling them to make informed, timely adjustments. By treating cash as the lifeblood of their operation, young entrepreneurs learn to rapidly innovate, identify lucrative revenue streams, or aggressively reduce their burn rate to avoid financial suffocation. The discipline to adapt and pivot in direct response to their cash flow reality often distinguishes businesses that endure beyond their first year from those that falter.

Success Stories: Young Founders Leveraging Financial Savvy and Early Investment

Several compelling examples underscore the transformative power of financial literacy and early investment in scaling youth-led ventures across diverse sectors and geographies. These cases illustrate that age is less a barrier and more a factor in how resources and knowledge are effectively leveraged. One of the most prominent examples is Stripe, founded by brothers John and Patrick Collison from the USA and Ireland. In 2010, when they created Stripe, they were just 19 and 21 years old, respectively20. Their entrepreneurial journey began even earlier; as teenagers, they had already successfully sold their first startup, Auctomatic, for \$5 million in 200820. This early exit, combined with their participation in Y Combinator’s accelerator program, provided them with crucial seed capital and invaluable mentorship. Stripe’s innovative online payments platform rapidly gained traction, eventually achieving a staggering valuation of \$95 billion by 202221, establishing itself as one of the world’s leading fintech companies. The Collisons’ success is a testament to their exceptional financial acumen from a young age; they maintained stringent control over unit economics, particularly how Stripe charged developers small, accumulative fees, and consistently impressed investors with their technical prowess and financial competence. This strong credibility enabled them to attract significant early investment, which was instrumental in fueling Stripe’s explosive global growth. Another inspiring narrative comes from India with OYO Rooms, founded by Ritesh Agarwal. His story epitomizes how targeted early investment and a commitment to learning can propel a youth-led venture to unicorn status. Agarwal dropped out of college at 17 to launch OYO, a marketplace focused on standardizing budget hotel experiences22. In 2013, he received a pivotal \$100,000 Thiel Fellowship grant, which not only provided capital but also exposed him to the mentorship and financial literacy principles prevalent in Silicon Valley22. By the age of 21 in 2015, Agarwal had successfully secured a \$100 million venture capital round led by SoftBank and other prominent investors23. These investors were reportedly impressed by his data-driven strategy for standardizing and aggregating low-cost accommodations. OYO’s network expanded rapidly across India and beyond. By 2018, at just 24 years old, Agarwal raised an additional \$1 billion, valuing OYO at \$5 billion and making it India’s second most valuable startup at the time24. The key takeaway from OYO’s journey is the transformative effect of early mentorship and funding; the Thiel Fellowship provided not just capital but also crucial financial education, enabling Agarwal to effectively manage investor funds and pitch his vision. This substantial early investment allowed him to rapidly scale operations and technology, demonstrating how a young founder can transition from an innovative idea to a multi-billion-dollar enterprise within just a few years, given the right financial backing and strategic know-how. On a different scale, Bella Lin, a 17-year-old from the USA, transformed a teenage side hustle into a six-figure business with GuineaLoft. In 2022, Lin identified an unmet need for improved guinea pig cages and, leveraging skills acquired from a youth entrepreneurship program, invested a modest \$2,000 of her personal savings to launch GuineaLoft on Amazon25. Her careful financial management and strategic reinvestment of profits into inventory and marketing yielded remarkable results. In 2023, her small pet products company sold approximately 11,000 units, generating an impressive \$409,000 in revenue26. By 2024, GuineaLoft’s monthly sales averaged \$71,000, doubling the previous year’s figures, 27 prompting Lin to consider deferring college to focus on business expansion. Lin’s story powerfully illustrates how early financial literacy and discipline can lead to significant cash flow success. She meticulously controlled overhead, tracked unit costs, and utilized insights from a finance mentor to optimize her Amazon listings. Her ability to manage both her academic studies and a thriving business underscores the immense potential of teen entrepreneurs who grasp budgeting and effective online marketing, enabling them to build successful ventures with minimal external capital. It also highlights the direct impact of early educational interventions, such as those provided by BizWorld, which directly contributed to her real-world business achievements. Finally, Eliab Mayengo from Uganda, founder of Orca-Pod Holdings, exemplifies scaling with seed capital and targeted skills development in an emerging market. Mayengo’s entrepreneurial spirit was evident from age 12, when he made clay bricks to fund his own education. As a young engineer, he founded Orca-Pod to industrialize brick-making, aiming to provide affordable housing materials. Despite his vision, Mayengo struggled with limited access to finance until 2018, when he was selected for the Tony Elumelu Foundation entrepreneurship program. This program provided him with a crucial seed grant, alongside invaluable financial training and mentorship. The impact was profound: within a year, Orca-Pod’s workforce expanded from 20 to 45 employees, and its annual revenue surged from UGX 145 million to UGX 201 million, representing approximately a 39% increase28. Mayengo strategically utilized these funds to construct an eco-friendly kiln and extend production into new districts. This case study powerfully demonstrates that even a modest early investment, when combined with essential financial literacy support, can dramatically accelerate a youth-led manufacturing business. Mayengo learned to meticulously segregate business finances, maintain accurate records, and craft a compelling case for securing additional capital. His journey illustrates the potent multiplier effect of providing promising young entrepreneurs with the “three M’s”: Money, Mentorship, and Markets. With this combination, he transformed a micro-operation into a scalable enterprise that not only grew his business but also addressed a critical local housing need, offering a replicable model for youth entrepreneurship in emerging economies. These diverse examples—from high-tech fintech unicorns to essential manufacturing and bespoke e-commerce—collectively underscore that financial understanding and timely access to capital are not just desirable but absolutely indispensable for young founders to navigate the complexities of entrepreneurship, overcome challenges, and ultimately achieve scalable, sustainable success. Next, we will explore the nuances of the financial literacy gap among young entrepreneurs, examining its consequences and potential solutions.

3. The Pervasive Financial Literacy Gap Among Young Entrepreneurs

The global landscape of youth entrepreneurship is experiencing an unprecedented surge in activity and interest. Nearly three-quarters of Generation Z (16–24-year-olds) express a desire to start their own businesses, a significantly higher proportion compared to older generations, signaling a worldwide boom in youth-led ventures[1]. This entrepreneurial drive is fueled by a dualistic force: both intrinsic ambition, reflecting a desire for independence, flexibility, and the pursuit of passion projects, and extrinsic necessity, often driven by high youth unemployment rates that compel young individuals to create their own economic opportunities[17]. For example, while the global youth unemployment rate stood at 13% in 2023 (the lowest in 15 years), it still far outstrips adult unemployment rates, with regions like South Africa facing a staggering 44.3% youth jobless rate for ages 15–34, transforming many into “necessity entrepreneurs”[11][18]. Technology has further lowered barriers to entry, enabling digital natives to launch businesses on online platforms with minimal upfront capital[17]. However, beneath this wave of entrepreneurial zeal lies a critical, often unaddressed Achilles’ heel: a pervasive financial literacy gap. While young entrepreneurs may possess innovative ideas and digital prowess, their foundational understanding of business finance is alarmingly low. This deficit profoundly impacts every stage of their venture, from initial planning and day-to-day cash management to securing external funding and preparing for long-term growth. The consequences of this gap are stark and contribute significantly to the high failure rates observed among startups and small businesses globally. This section will delve into the extent of this financial literacy gap among young entrepreneurs, analyze its multifaceted impact on their ventures, and underscore the critical need for targeted interventions.

3.1 The Alarming State of Financial Literacy Among Young Adults

Financial literacy is the ability to understand and effectively use various financial skills, including personal financial management, budgeting, and investing. For entrepreneurs, this extends to business-specific concepts like cash flow, profit and loss, balance sheets, and funding strategies. Despite its undeniable importance, proficiency in these areas is conspicuously absent among the younger demographic.

3.1.1 Global Financial Illiteracy Rates and Youth Disadvantage

Data reveals a troubling global trend:

- Only about one-third of adults worldwide are financially literate, meaning a staggering 3.5 billion people lack a basic understanding of financial concepts[3][8]. This includes men (35%) and women (30%) globally, but the rates are even lower in emerging economies, often falling below 25%[8].

- Alarmingly, among the crucial 18–25 age group, the proficiency rate for financial literacy is “shockingly low” – with only around 7% deemed sufficiently financially literate in global assessments[10][6]. This indicates that the vast majority of young founders enter the entrepreneurial arena with minimal financial skills, relying heavily on trial-and-error, an approach fraught with peril for a burgeoning business.

- A survey of Gen Z aspiring entrepreneurs underscored this self-awareness, finding that 67% admit they lack sufficient financial knowledge to confidently run a business[13][2]. This statistic highlights not only the objective gap in knowledge but also the subjective feeling of unpreparedness among young individuals embarking on entrepreneurial journeys.

This widespread lack of financial education means that many young entrepreneurs are ill-equipped to handle the complex financial demands of running a business. They often lack formal training in financial management, budgeting, accounting practices, or understanding capital structures, leaving them vulnerable to critical errors.

| Demographic | Financial Literacy Rate | Source |

|---|---|---|

| Adults Worldwide | ~33% | S&P Global FinLit Survey (2015)[3][8] |

| 18–25 Year Olds | ~7% | Prof. Annamaria Lusardi (2022)[6][10] |

| Gen Z Aspiring Entrepreneurs (self-reported lack of know-how) | 67% | TD Bank Group Survey (2025)[13][2] |

Table 1: Financial Literacy Rates Across Demographics

3.2 Impact on Business Planning and Financial Management

The financial literacy gap has tangible and detrimental consequences for the operational health and strategic direction of youth-led ventures. Without a solid financial foundation, business planning becomes speculative, cash management perilous, and overall financial discipline elusive.

3.2.1 Deficient Business Planning and Budgeting

A lack of financial understanding often translates into underdeveloped or unrealistic business plans. Young entrepreneurs may struggle with:

- Accurate Cost Estimation: Underestimating startup costs, operational expenses, and the time needed to reach profitability. This leads to early cash depletion and the inability to sustain operations.

- Pricing Strategies: Inability to correctly price products or services to cover costs, achieve desired profit margins, and remain competitive. Pricing too low can hinder sustainability, while pricing too high can deter customers.

- Financial Projections: Producing credible financial forecasts, including revenue projections, profit and loss statements, and cash flow statements, which are crucial for both internal decision-making and external funding acquisition.

These deficiencies mean that many young founders launch their businesses without a clear financial roadmap, making them reactive rather than proactive in their management.

3.2.2 Precipitous Cash Management and Its Consequences

Cash flow is widely acknowledged as the lifeblood of any business, and poor management of it is a primary driver of business failure.

- An estimated 82% of small businesses fail due to cash flow problems, underscoring that liquidity, not just profitability, is paramount for survival[7][21].

- Common cash management pitfalls include:

- Commingling Funds: A fundamental error where personal and business finances are not strictly separated. This makes accurate business performance tracking impossible and can lead to personal financial instability if the business struggles, or business instability if personal needs drain company funds[23]. Nearly 1 in 5 Gen Z entrepreneurs resort to personal savings or debt to sustain their businesses, blurring this critical line[14].

- Lack of Expense Tracking: Inadequate record-keeping means entrepreneurs often don’t know where their money is going, leading to uncontrolled spending or missed opportunities for cost optimization.

- Poor Receivables Management: Failing to issue invoices promptly or follow up on overdue payments can severely impact a business’s cash inflow, even if sales are strong.

- Insufficient Cash Reserves: Without accurate financial forecasting, businesses often lack the necessary buffer to navigate unexpected expenses, seasonal dips, or delayed payments, leading to a “feast-and-famine” cycle[24].

These operational deficiencies highlight why basic financial discipline—such as budgeting, bookkeeping, and prudent financial controls—is essential. Young leaders who master these are far more likely to achieve positive cash flow and ensure the longevity of their venture.

3.3 Debt Management and Funding Readiness

The financial literacy gap also profoundly impacts young entrepreneurs’ ability to access and manage capital, which is a significant hurdle for scaling their ventures.

3.3.1 Challenges in Securing Funding

Securing early-stage funding is a critical hurdle for all startups, but young entrepreneurs face particular disadvantages: